Best Maruti Suzuki Financial Analysis

Established in February 1981 though the actual production commenced in 1983 with the Maruti 800 based on Suzuki alto kei.

Maruti suzuki financial analysis. 2004-Maruti closed the financial year 2003-04 with an annual sale of 72122 o units the highest ever since the company began operations 20 years ago. Reported Standalone quarterly numbers for Maruti Suzuki India are. Which was almost half of ET Now Poll of Rs8192Cr.

EBITDA was reported at RS8211Cr with EBITDA Margins at 46. Current Ratio x 067. NSE Gainer-Large Cap.

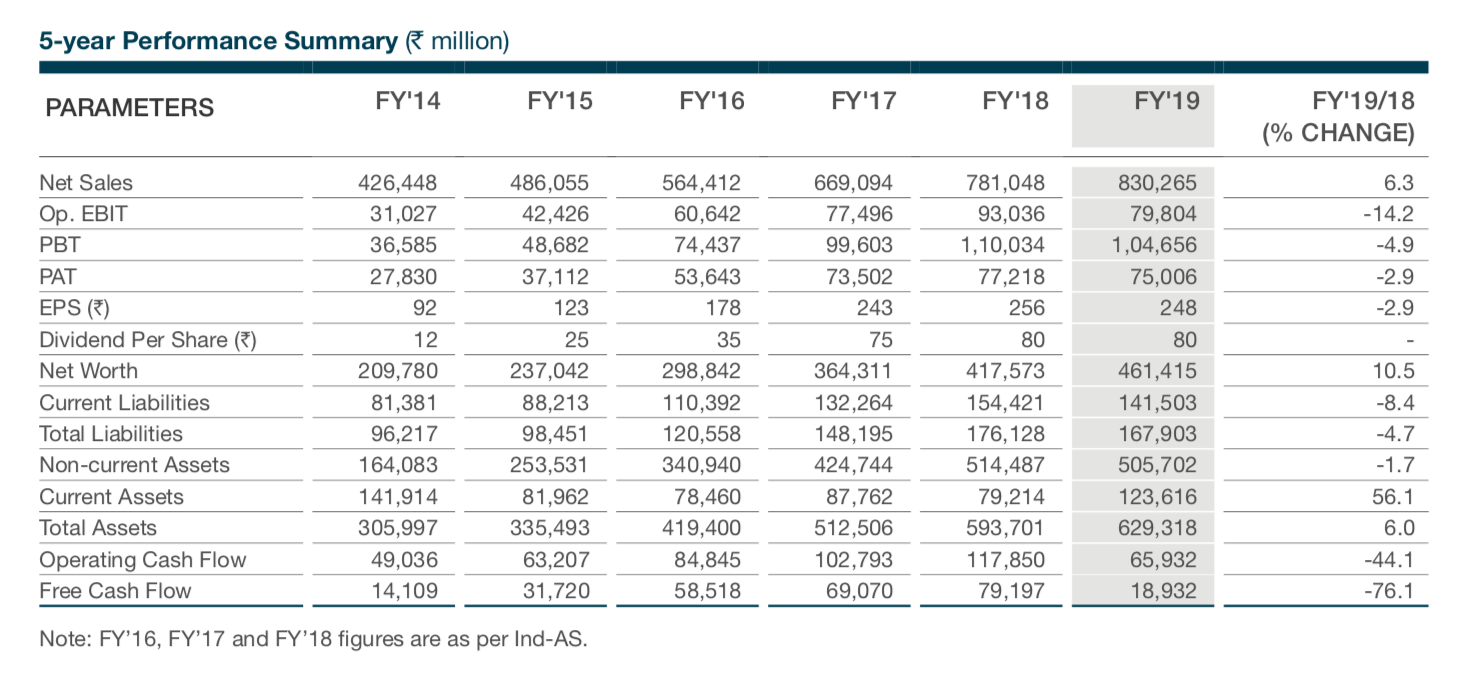

Commodity Price Inflation and Weak operating leverage has been hitting the Margins. Consolidated net sales including other operating income of Maruti Suzuki India. NOW WE ARE ANALYSING RATIOS OF MARUTI SUZUKI IN REFERECE TO ABOVE MENTION BALANCE SHEET AND PL AC LIQUIDITY RATIOS.

Presently Suzuki Motor Corporation owns equity of 562. Maruti Suzuki India Balance Sheets - Get the latest Financial Reports Balance Sheets of Maruti Suzuki India on The Economic Times. Market Capitalization The EVEBITDA NTM ratio of Maruti Suzuki India Limited is significantly higher than the median of its peer group.

2005- Maruti Udyog Limited has reached the highest market share in Indian car sales with 53. Liquidity ratio can be categorized in three categories as below in reference to Maruti Suzuki Ltd. And the services provided by Maruti Suzuki are automotive finance and Vehicle services.

Get latest Key Financial Ratios Financial Statements detailed profit and loss accounts of Maruti Suzuki India Ltd at The Financial Express. Quick Ratio x 029. Of affirm from accounting and financial statements.