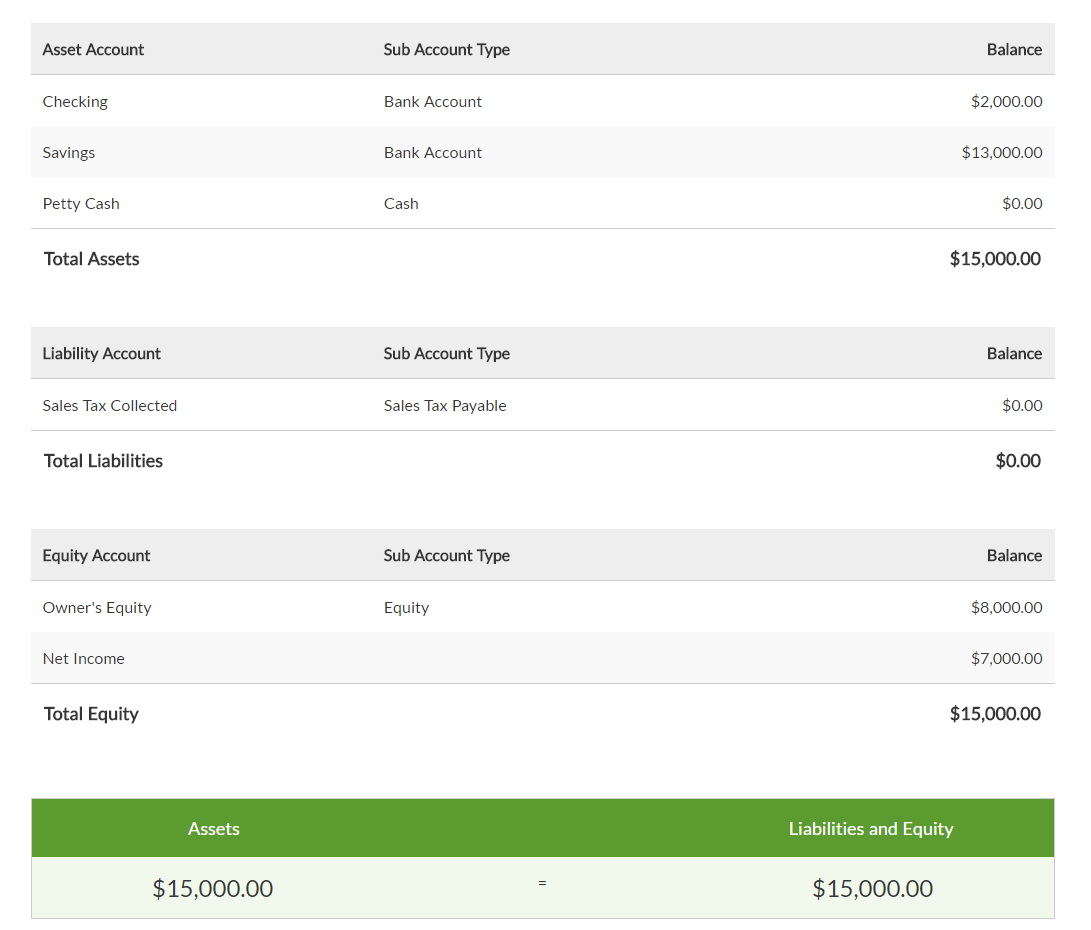

Amazing Cash Basis P&l

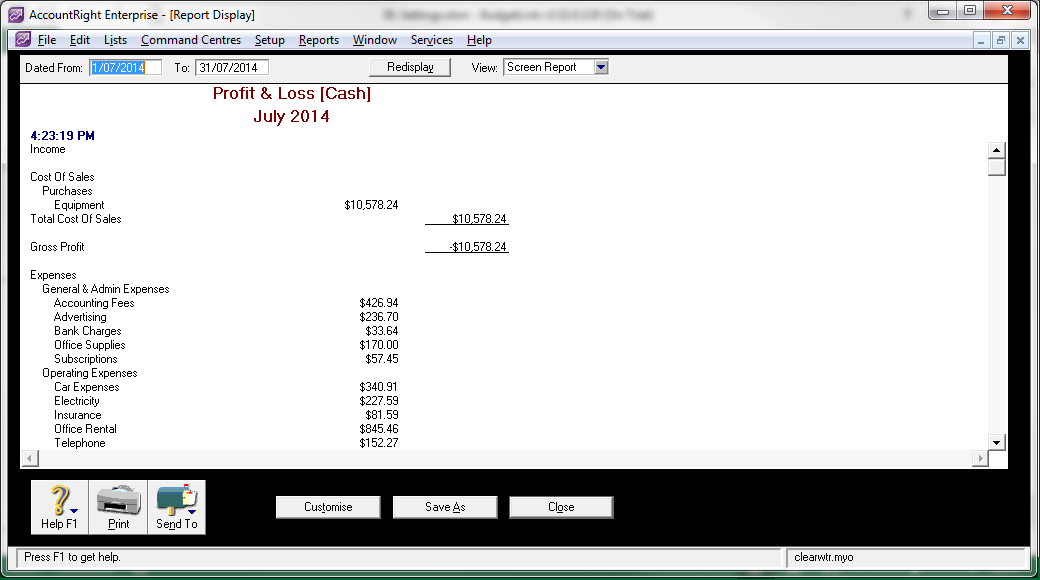

A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a companys revenues expenses and profitslosses over a given period of time.

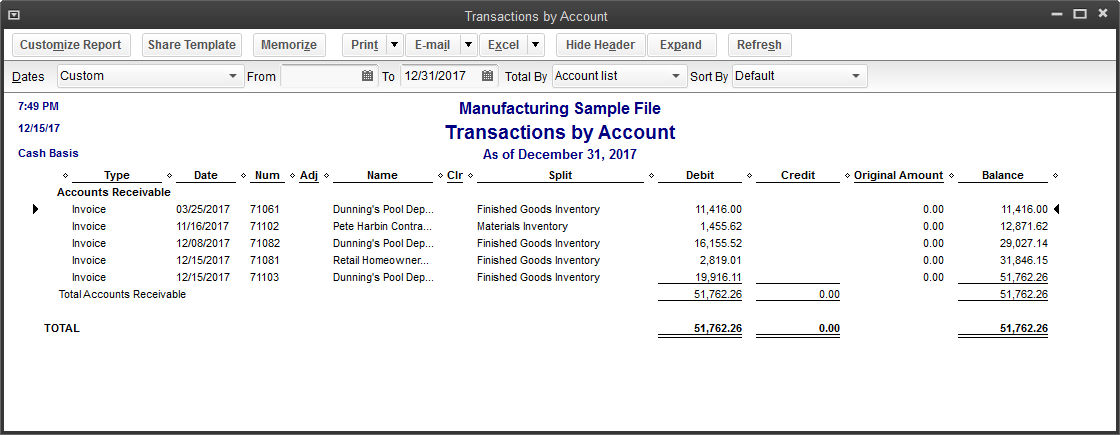

Cash basis p&l. However when paying the invoice 12282019 before the invoice date it will not reflect in the Profit and Loss Cas Basis report. The cash basis is only available for use if a company has no more than 5 million of sales per year as per the IRS. Expenses are only recorded when cash is paid out.

Similarly a check is cash basis whether or not it ever clears the bank. The nett result is that the expense item discounts given ie paypal fees does not show up on a cash basis PL report but does on a accruals basis PL report. A profit and loss PL statement summarizes the revenues costs and expenses incurred during a specific period of time.

PL Under the cash method income is only recorded if the money is actually received. Most individuals and many small businesses use the cash basis method of accounting. Cash Basis Accounting Revenue is reported on the income statement only when cash is received.

All accounting events in QB are by their nature cash basis except for AR and AP transactions. All accounting systems have limitations QB is no different. Similarly expenses are recorded only if cash really left the bank account.

Income With Cash vs. On the cash basis your Profit Loss PL would show a 120000 profit in 2018 because you collected the full fee on 122918 and a 24000 loss for 2019 because you had no additional collections but paid your hosting costs of 2000 per month. You now have your votes back.

The Cash basis report only shows income if you have received cash and expenses or if you have paid cash. The profit and loss statement or PL is a financial statement a company uses to report its profit -- the difference between its total income and total expense for the period. This is not an accurate representation of your companys performance.