Supreme Profit And Loss Account In Agriculture

Ad Find Profit Loss Statements.

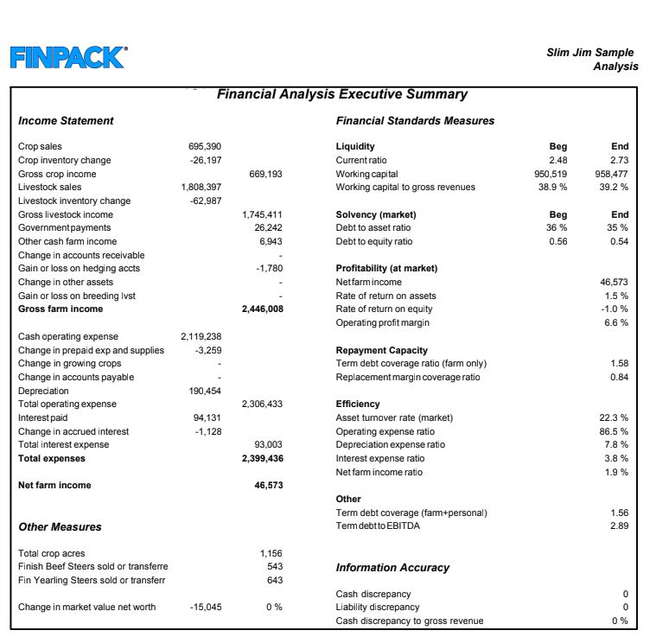

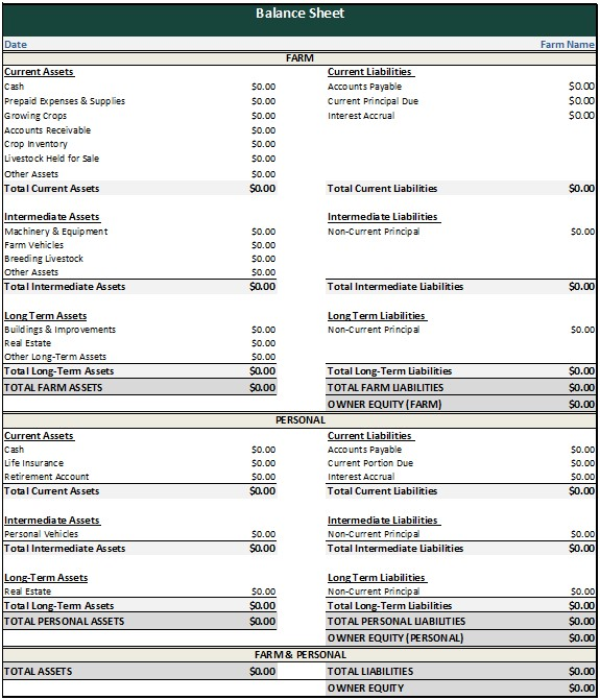

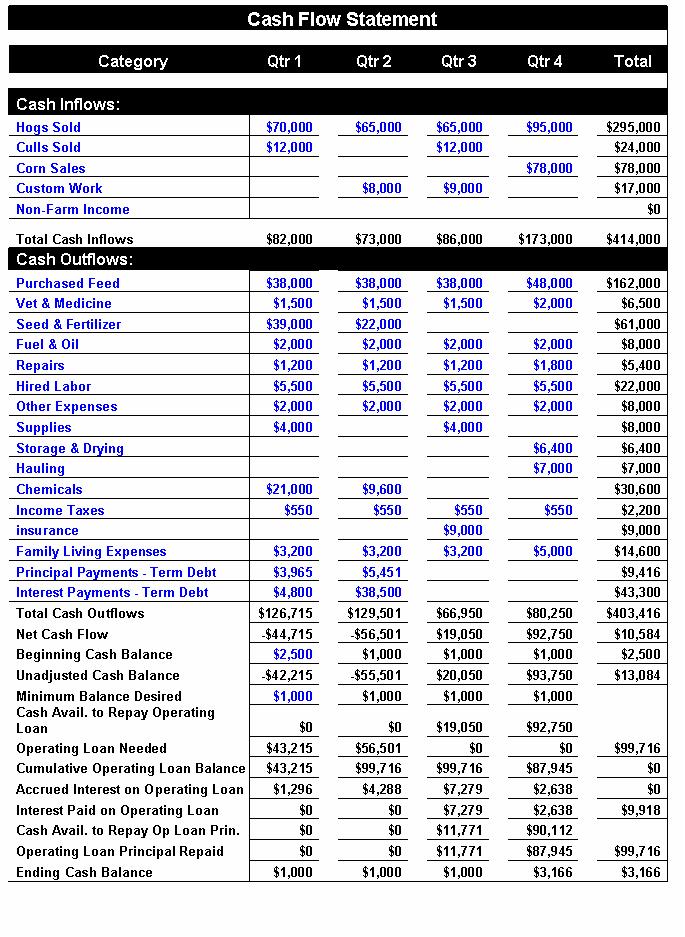

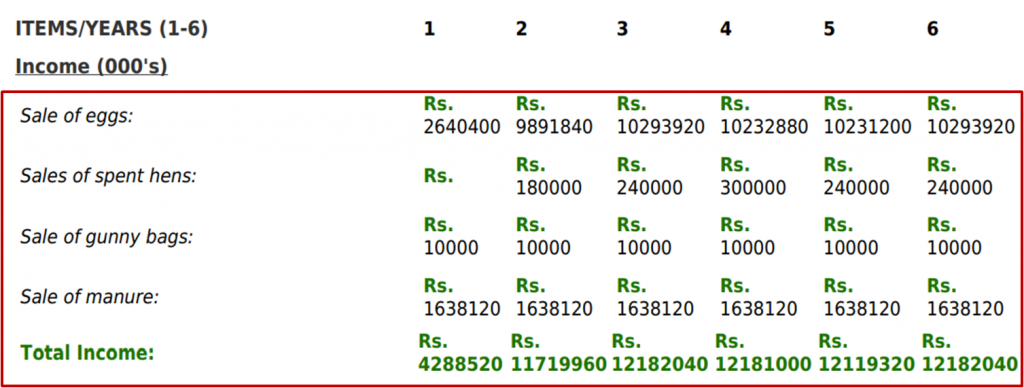

Profit and loss account in agriculture. Farm Viability Tax costs Most profit and loss are assessed prior to tax but as tax paid to the ATO is a legitimate business cost this can be included in the profit and loss. A farms financial accounts are made up of a profit and loss account a balance sheet and notes to the accounts which describe the accounting policies used to prepare the accounts. The cash transactions expenses and receipts are recorded in a cash analysis book as shown in table 163.

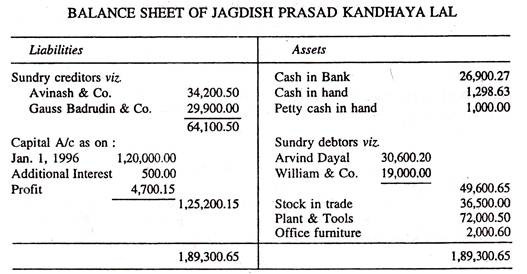

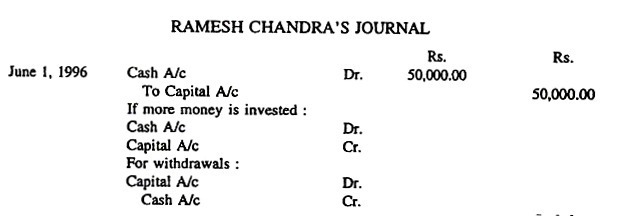

Whenever a business earns any net profit or incurs any net loss as shown in its profit and loss account it is adjusted into the capital. 1 Cash analysis account book is the most important financial record to be maintained by the farmer. Ad Find Loss Profit Statement.

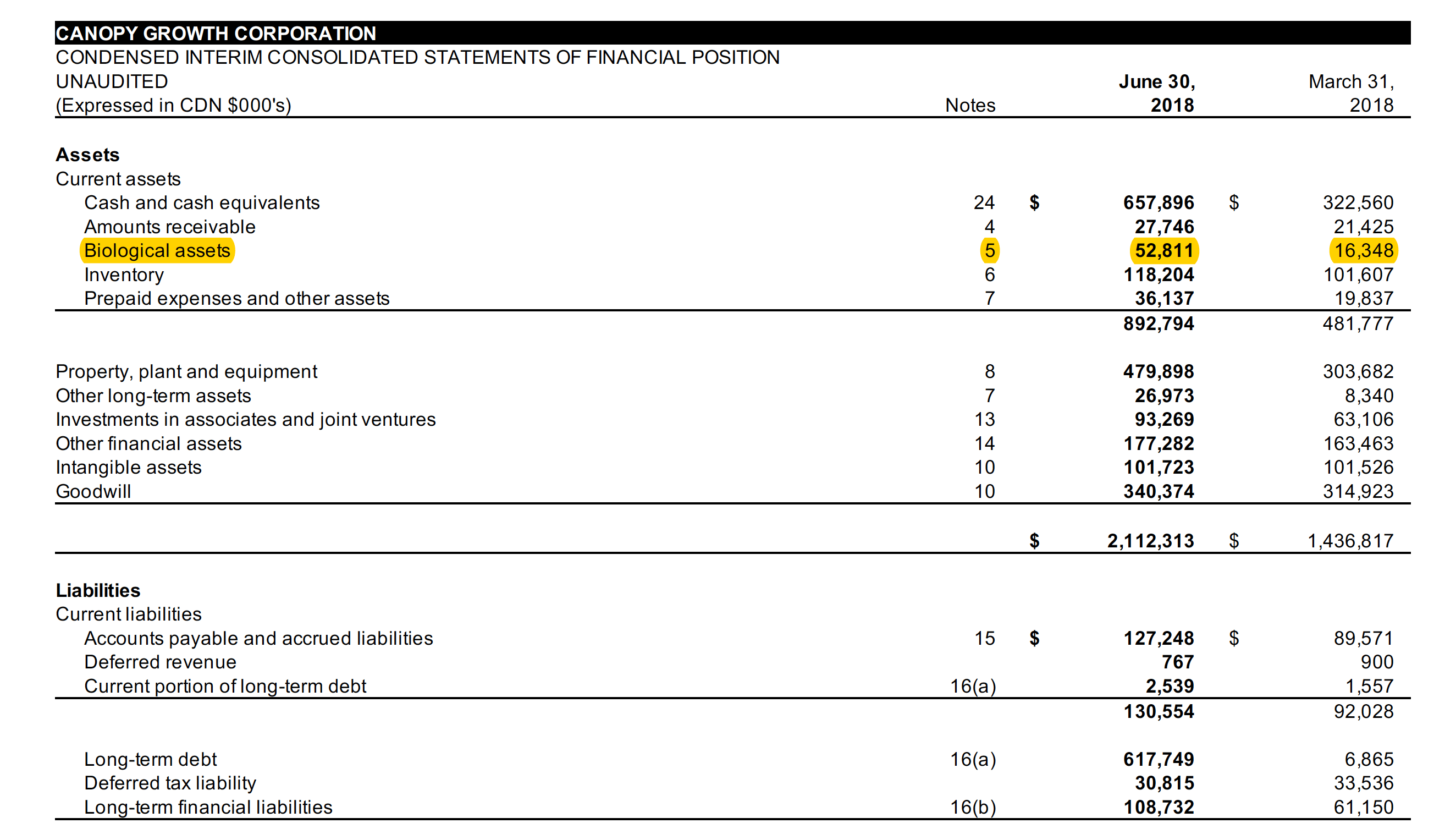

Ad Find Loss Profit Statement. Simple excel-based Dairy PL spreadsheet. 2 PricewaterhouseCoopers A practical guide to accounting for agricultural assets IAS 41 Agriculture is a small standard with a wide scope and a significant impact on those entities within its scope.

ProfitLoss From Continuing Operations-479-128. The farm accounting is a technique of using accounting data for cost and profit ascertainment of each farming activity and decision making. It applies to most but not all entities that grow or rear biological assets for profit.

Profit and loss account describes the businesss financial transactions and the resulting profit or loss for the trading period. Content updated daily for loss profit statement. This booklet looks at the profit and loss account and shows the main differences.

On the other hand if the business incurs a loss the capital invested by the business owner is reduced because the business would have to pay for the. ProfitLoss For The Period-479-128. Calculating Profit and Loss in Grain Futures Each penny of movement in these grain futures will result in a profit or loss for the trader in the amount of 50.