Favorite Gratuity Treatment In Balance Sheet

Amortization of Loss Gain recognized-309.

Gratuity treatment in balance sheet. 3 No it should only accounted in the trust books. Employee Benefits SHORT-TERM EMPLOYEE BENEFITS Requirement Recognise a Liability for employee benefits to be paid in the future for work already done Recognise an Expense when the employees services are used Accounting Treatment Dr Employment Cost eg. This Calculation Sheet may help to Calculate the all Private CoLtd.

C Obtain a list of employees with date of joining to ensure that on those with stipulated number of years service are considered. The Employer Company has decided to create a Gratuity Trust in order to manage the Gratuity liability for their employees. Then the same will be treated in the books as follows.

X X X X Extracts X X X X. D Check basic salary. Ii Trace last years balance with last years working paper me.

The trust would be assessable as an AOP as per clause iv to first proviso to section 164 1. Trust must have a separate PAN card. The amount represents accumulated amount of net earnings by a company since its inception.

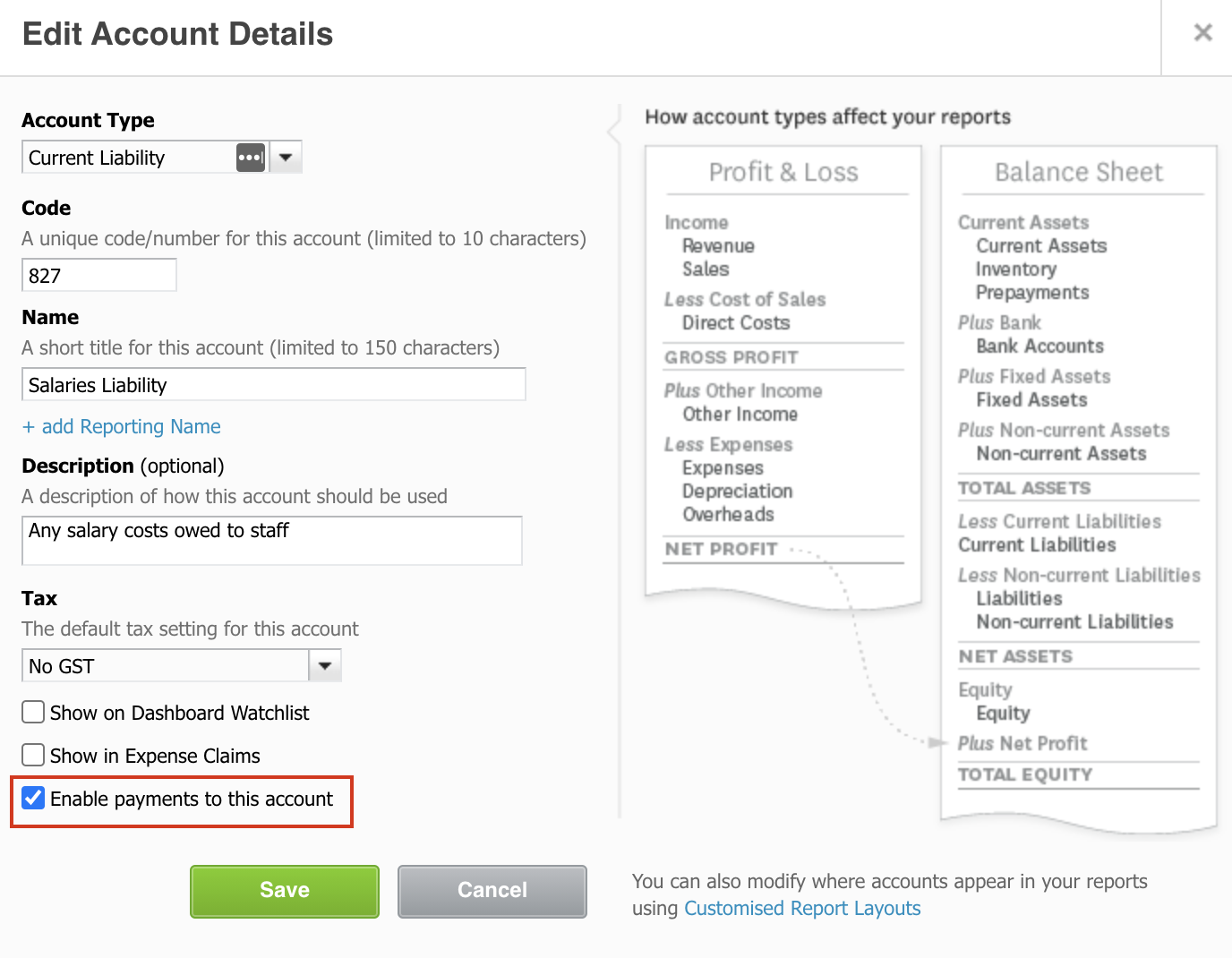

An approved gratuity trust will be treated as a separate legal entity under Income Tax Act. To Provision for Gratuity Ac b. 4 Form a gratuity trust apply for approval from income tax and open bank accounts.

Accounting Treatment of Retained Earnings. A gratuity is a payment made at the discretion of the customer and the customer solely determines the amount of the payment. Under Accounting Standards that are used in India such as Ind AS 19 and As 15 R gratuity has to be accounted as a liability when the employee has rendered service to the company and is recognised as an expense when the company consumes benefit arising out.

:max_bytes(150000):strip_icc()/Ford_Pension-266748d9d69f40208878c0917b463882.png)

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)