Neat Reclassified Income Statement

The statement should be classified and aggregated in a.

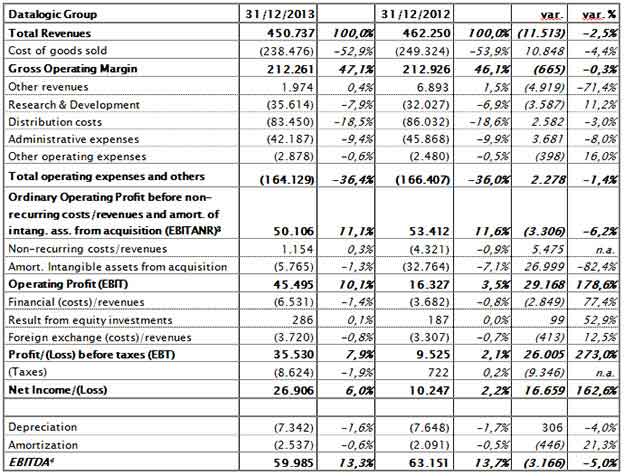

Reclassified income statement. Items that are not reclassified to income in later periods. The reclassified assets are subsequently measured at amortised cost using the effective interest rate determined at the date of reclassification. A classified income statement is a financial report showing revenues expenses and profits for which there are subtotals of the various revenue and expense classifications.

To facilitate the reading of the income statement in view of the fact that Snam SpA. Reconciliation of reclassified financial statements. Reclassified balance sheet items.

1a An income statement for the group together with a comparative statement for the corresponding period of the immediately preceding financial year. Reclassification adjustments are adjustments for amounts previously recognised in the comprehensive income now reclassified to profit or loss. Reclassified to the income statement -00 25 Items that will not be reclassified to the income statement Net unrealised gainslosses on equity instruments designated at FVOCI 481-47 -69 Gainslosses from own credit risk on financial liabilities designated at fair value 09-46 07.

Reclassified income statement In order to facilitate the reading of the Income Statement taking into consideration the nature of Snam SpA. Is an industrial holding company the following. Retirement benefits remeasurements 2702 2102 3588.

Group Increase FY20211 FY20202 Decrease RM RM Unaudited Audited. Foreign exchange gains and losses arising from translations of financial statements of a foreign operation IAS 21 Effective portion of gains and losses on hedging instruments in a cash flow hedge IAS 39 OCI items that cannot be reclassified into profit or loss. 1ai An income statement and statement of comprehensive income or a statement of comprehensive income for the group together with a comparative statement for the corresponding period of the immediately preceding financial year.

OCI items that can be reclassified into profit or loss. As an industrial holding company the Reclassified Income Statement was prepared by presenting items relating to financial management first because they represent the most important component of an income nature 33. - the other gains and losses deriving from gains from sales of fixed assets 1 million and compensation for damages 2 million have been recorded as increases under the corresponding cost items in the reclassified income.