Breathtaking Repayment Of Notes Payable Cash Flow

The entry in Case 1 is straightforward.

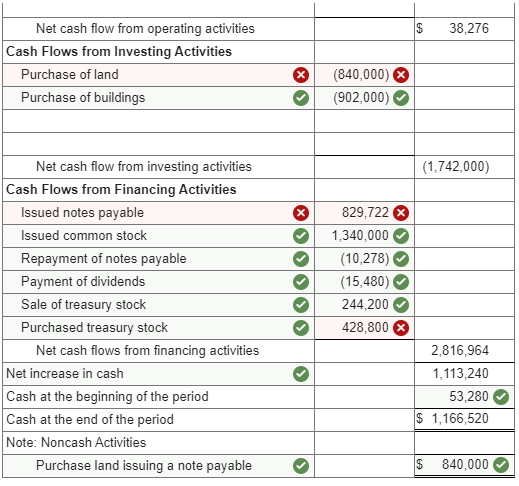

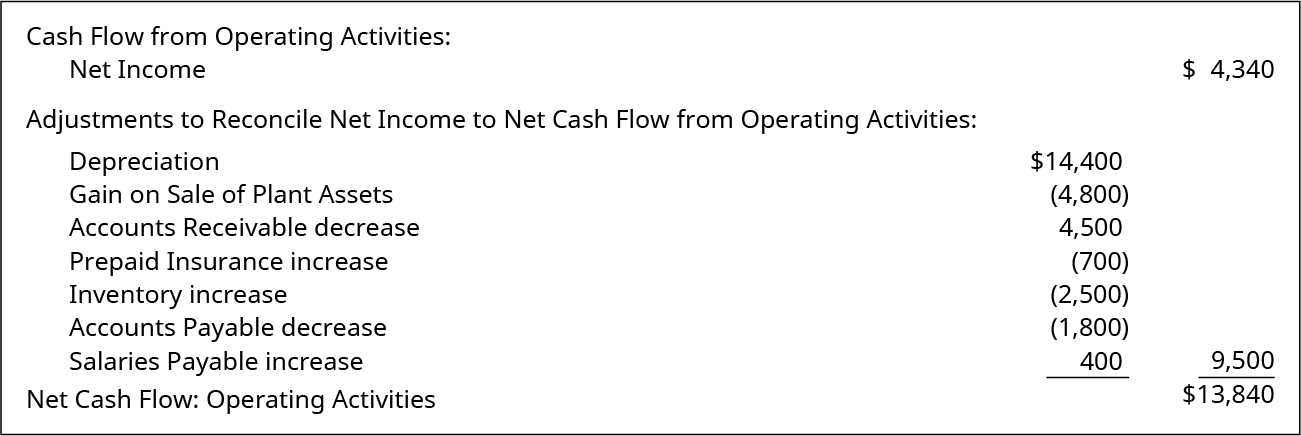

Repayment of notes payable cash flow. For a short-term note a company records the cash outflow in the operating activities section of the statement of cash flows. And cash outflows that are incurred while repaying such funds such as redemption of securities payment of dividend loan interest repayment. Calculating the cash flow from investing activities is simple.

Investing Activity On A Cash Flow Statement O B. In Case 2 Notes Payable is credited for 5200 the maturity value of the note but S. Purchase of a companys own stock treasury stock Declaration and payment of dividends.

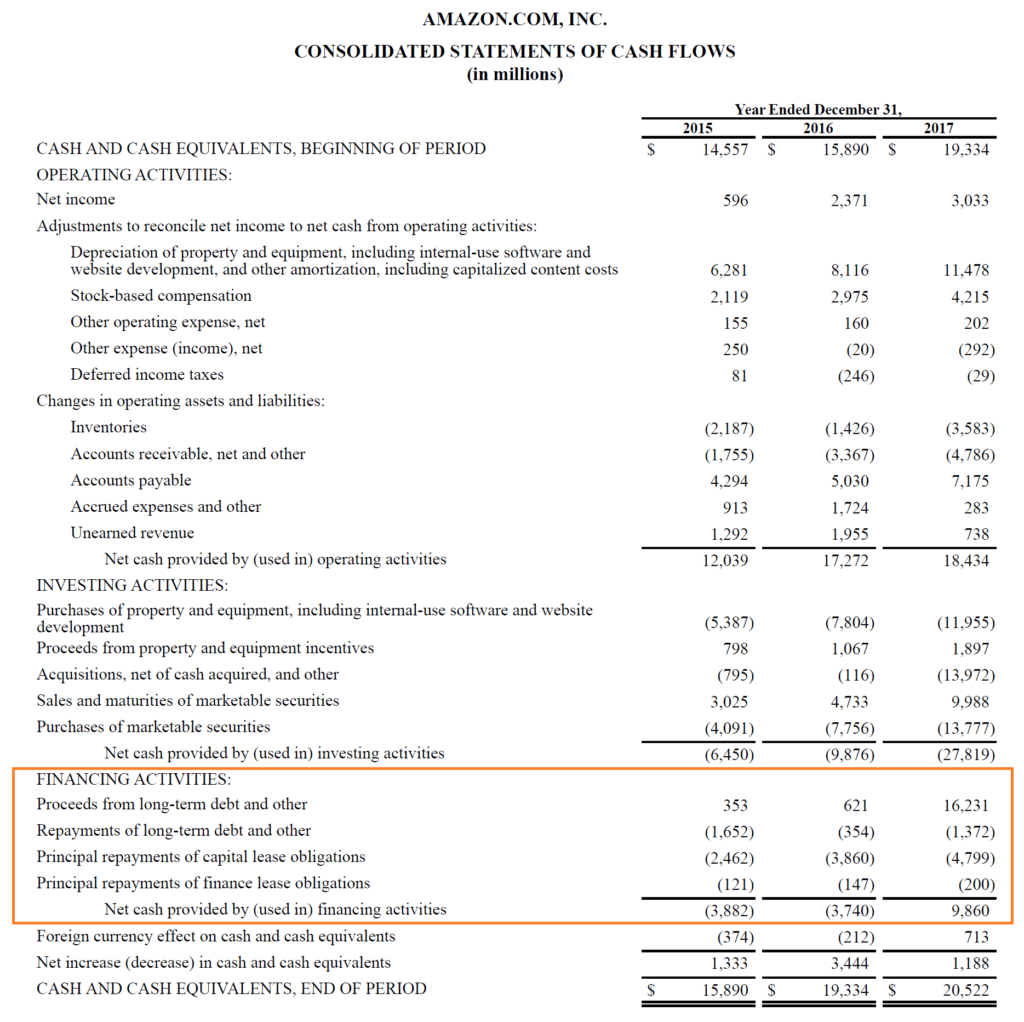

It is the last of the three parts of the cash flow statement that shows the cash inflows and outflows from finance in an accounting year. Other decreases in long. On the other hand interest paid shows up in cash flow to creditors but not repayments of note principal which show up in the change in NWC.

The interest represents 8 of 10000 for half of a year January 1 through June 30. Repayment of short-term loans andor long-term loans. Financing Activity On A Cash Flow Statement.

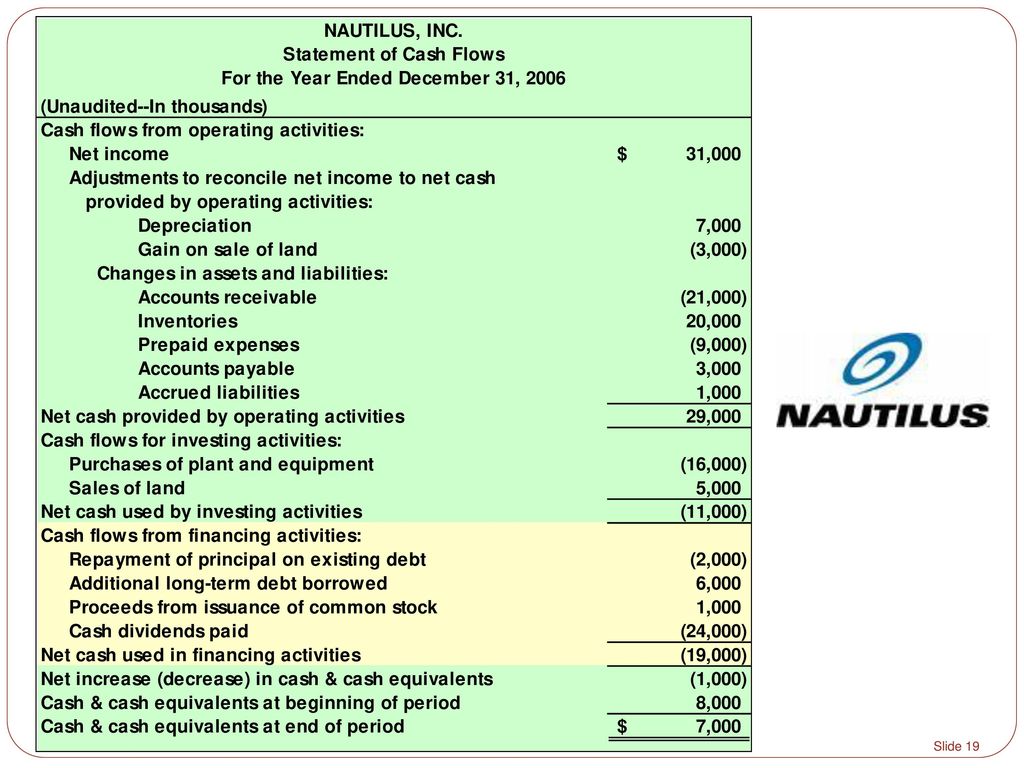

The repayment accounting entries are to debit notes payable by the principal amount of the note and credit cash. Issuance of the Note. Cash is debited and Notes Payable is credited for 5000.

Notes payable are written agreements promissory notes in which one party agrees to pay the other party a certain amount of cash. A note payable is a debt that is established with a written agreement such as a bank loan. The journal entries to record this note under each of the two cases are.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)