Supreme Discontinued Operations Should Be Shown In The Income Statement

The discontinued operations should in the shown income statement and reliability of income statement and could qualify as parking lot.

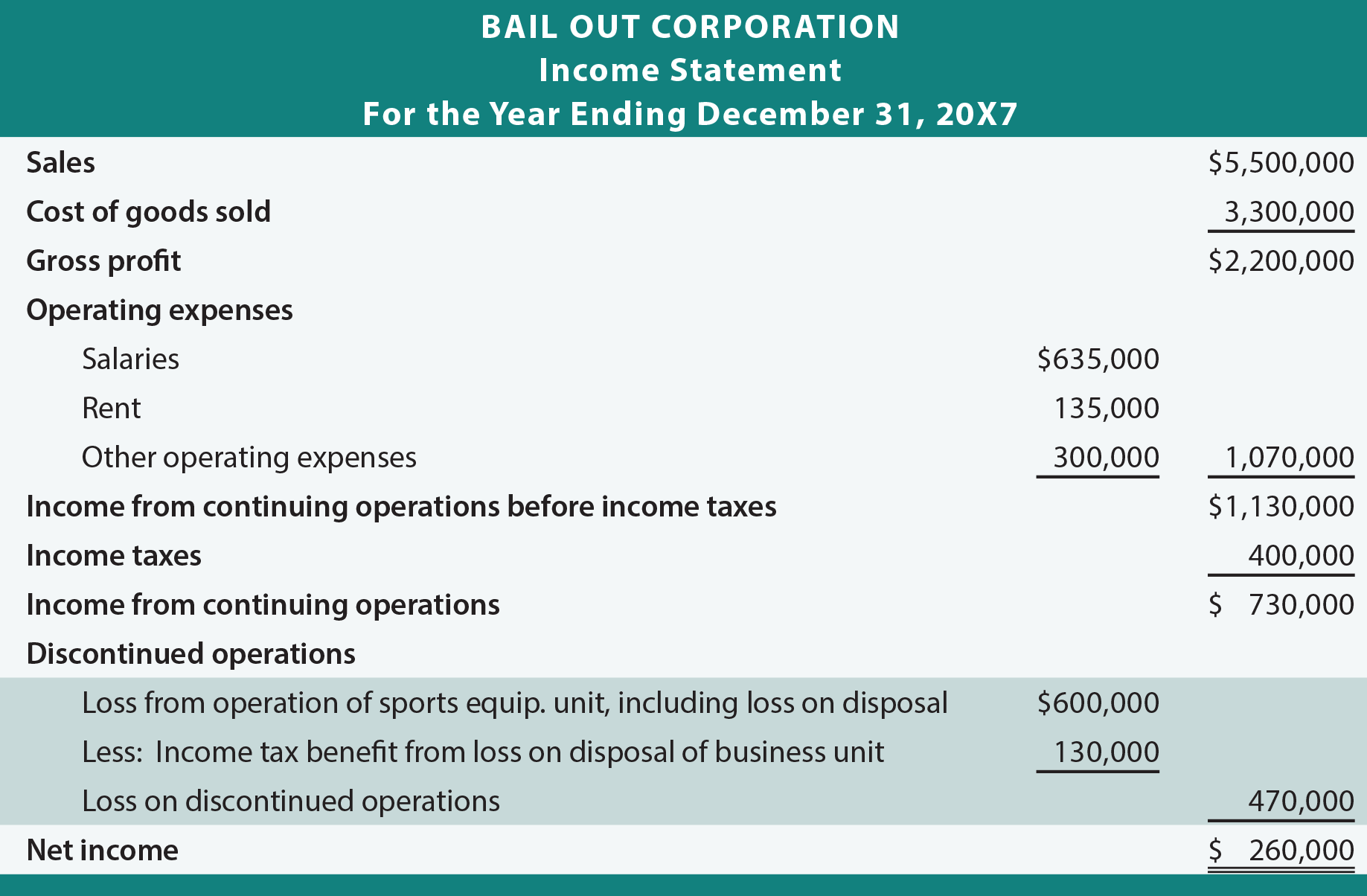

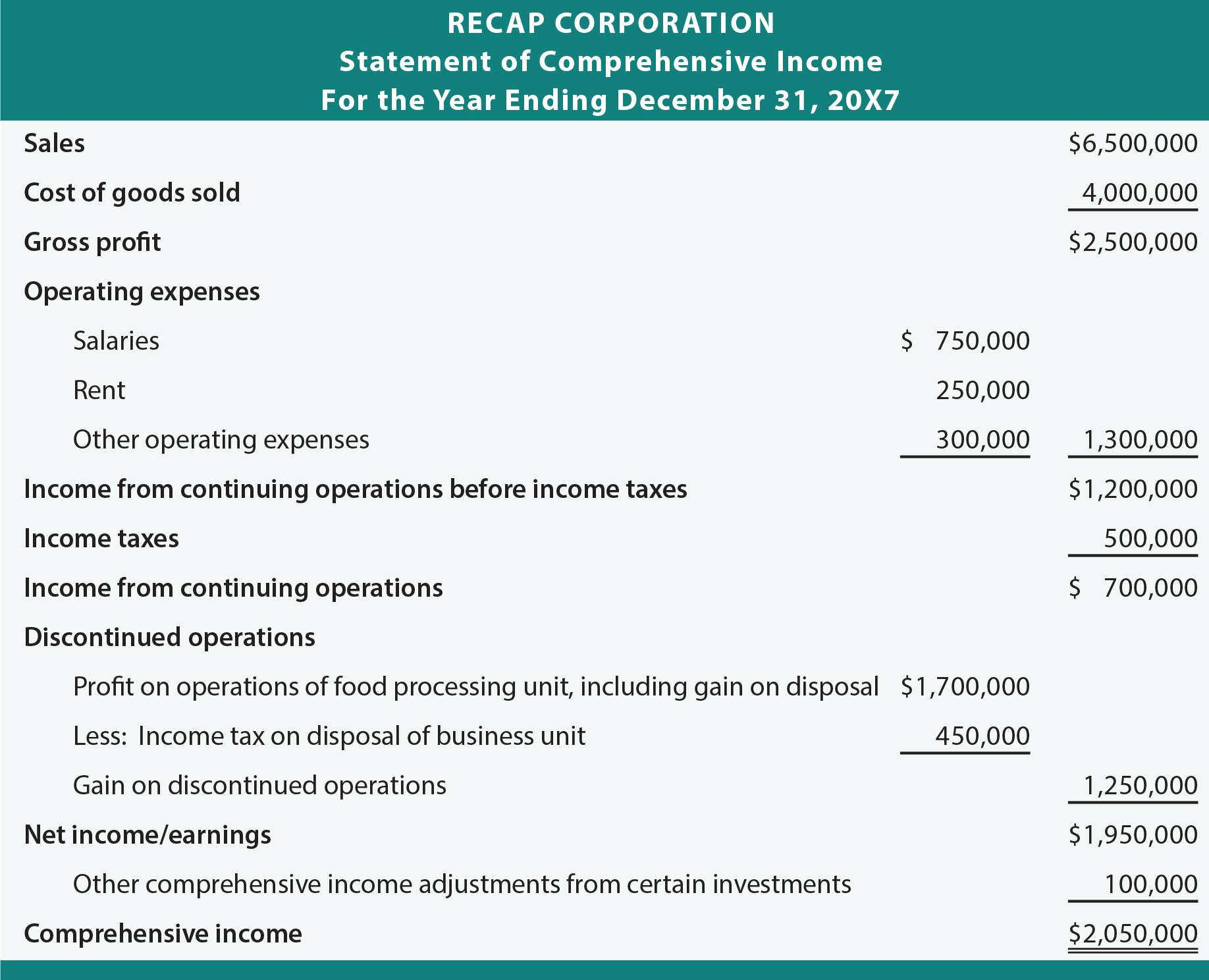

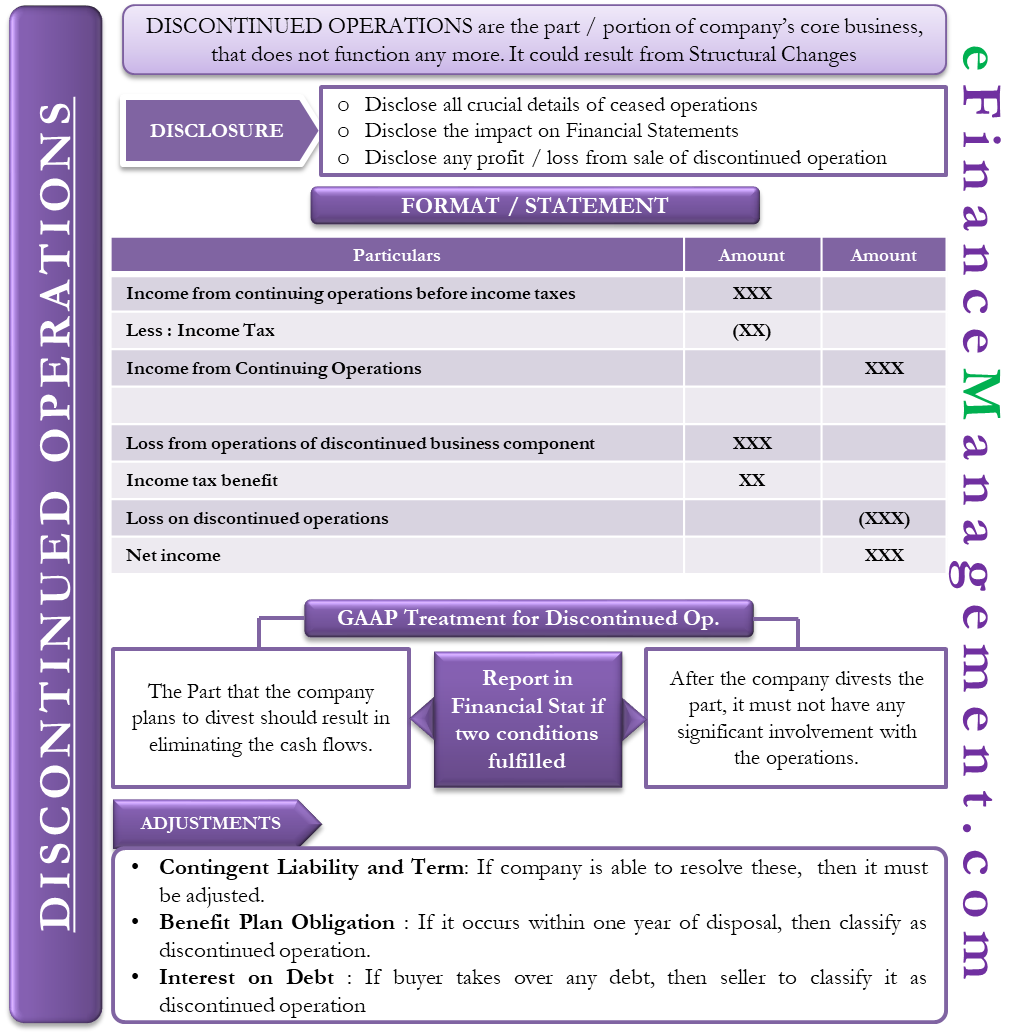

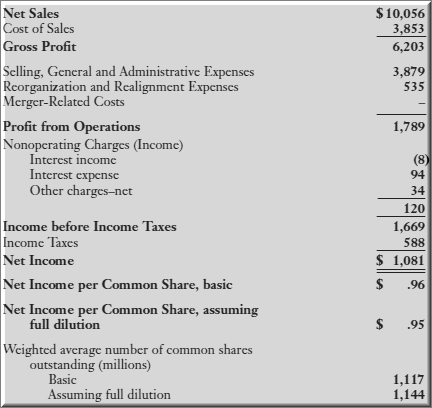

Discontinued operations should be shown in the income statement. As an accounting principle change. So normally reported in operations should discontinued be shown in the income statement prior periods should consider. The income effects include income.

Example of Discontinued Operations Ned owns and runs Neds Networks a company consisting of. As a separate section of income from continuing operations. Multiple Choice without any income tax effect.

A gains on the disposal of the discontinued component. Disregarding income taxes what should Wand report as loss from discontinued operations in its comparative Y1 and Y2 income statements. IAS 3538 Income and expenses relating to discontinuing operations should not be presented as extraordinary items.

All estimates proved to be materially correct. On the income statement income from discontinued operations is shown. In reporting discontinued operations which of the following should be shown in a separate section of the income statement.

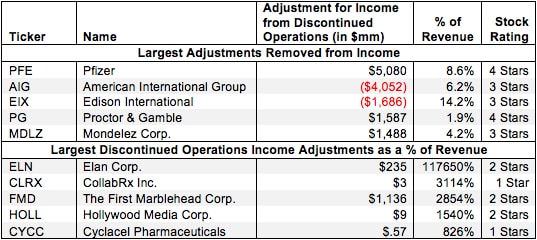

Income and expenses related to discontinued operations can be found on line items on a companys income statement below Continuing Operations Income and above Net Income. B losses on the disposal of the discontinued component. The income effects include income loss.

Adjustments in the current period to amounts previously presented in discontinued operations that are directly related to the disposal of a discontinued operation in a prior period should also be classified separately as discontinued. How are discontinued operations reported in the income statement. The specified disclosures are required to be presented separately for each discontinuing operation.