Fabulous Statement Of Functional Expenses

Other software use tags representing a specific.

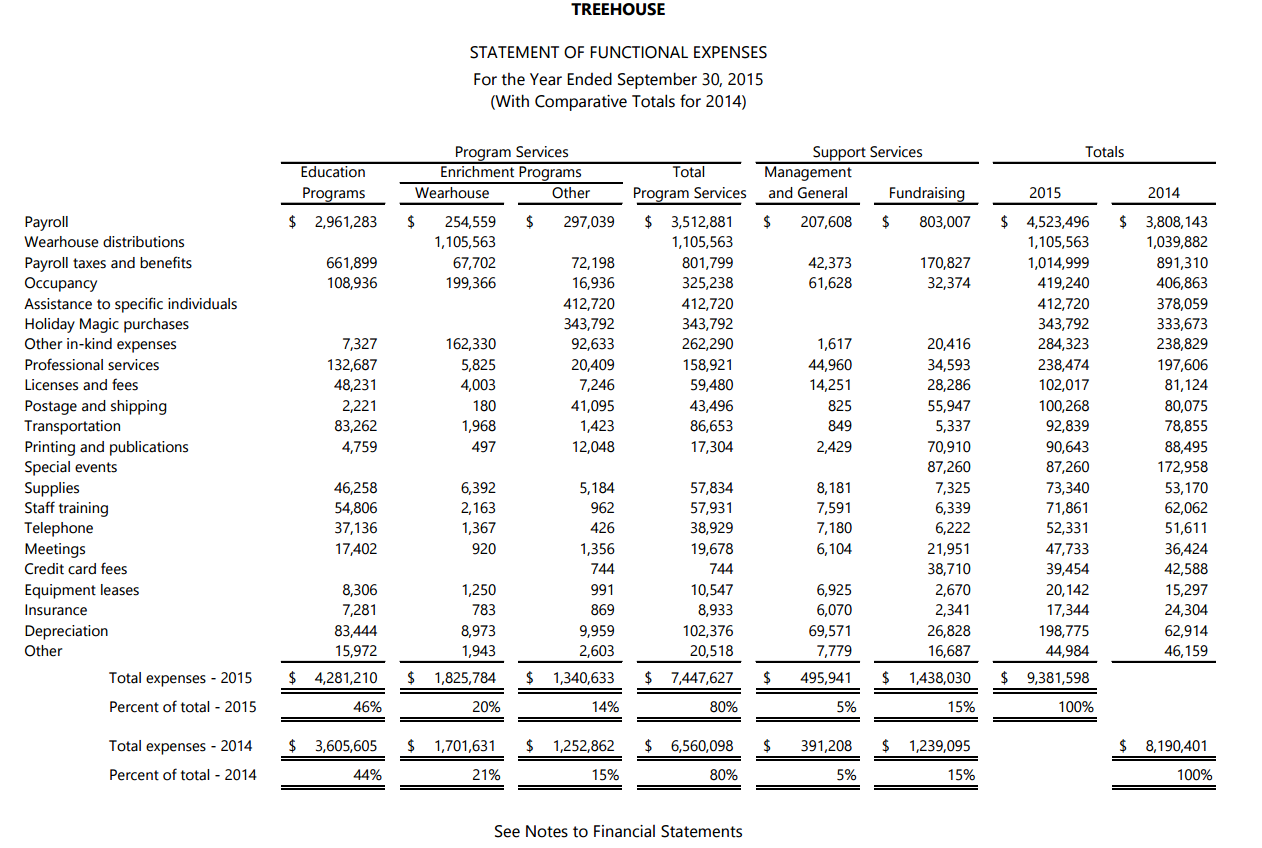

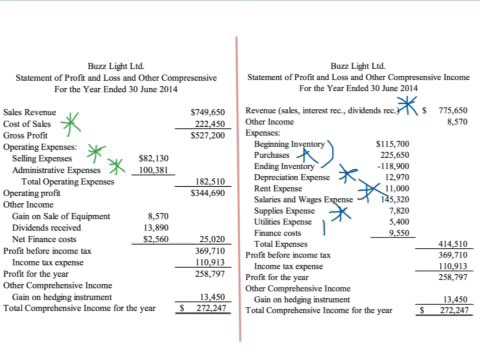

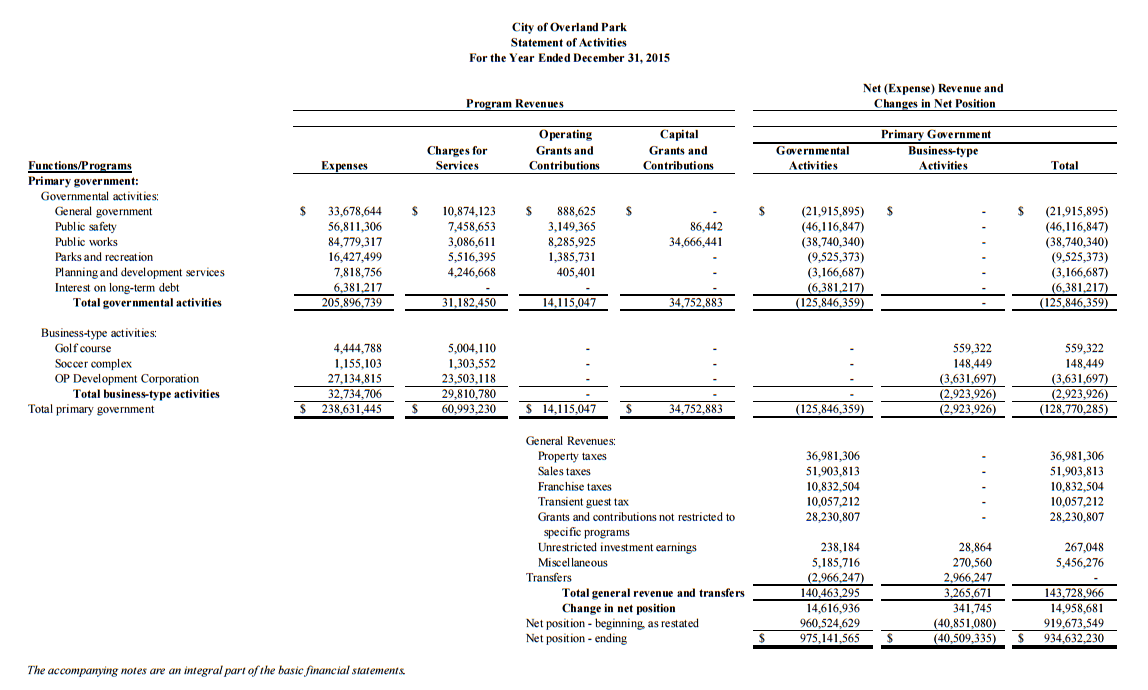

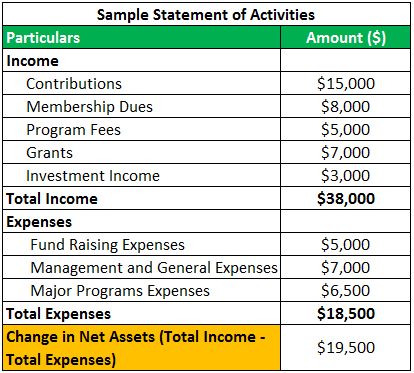

Statement of functional expenses. Coding day-to-day expense transactions. Functional expenses explain the purpose of an expense by category. Manufacturing selling general administrative and financing.

STATEMENT OF FUNCTIONAL EXPENSE INSTRUCTIONS In General All organizations who complete the IRS Form 990 N post card 990-EZ 990-PF or who do not complete any 990 must complete the Statement of Functional Expense Form. Statement of Functional Expenses The statement of functional expenses is described as a matrix since it reports expenses by their function programs management and general fundraising and by the nature or type of expense salaries rent. Natural classifications explain what the money was sent on eg.

Functional classification by class QuickBooks uses classes. With FASBs issuance of Accounting Standards Update ASU 2016-14 Not-for-Profit Entities Topic 958. Functional Expenses and Bookkeeping.

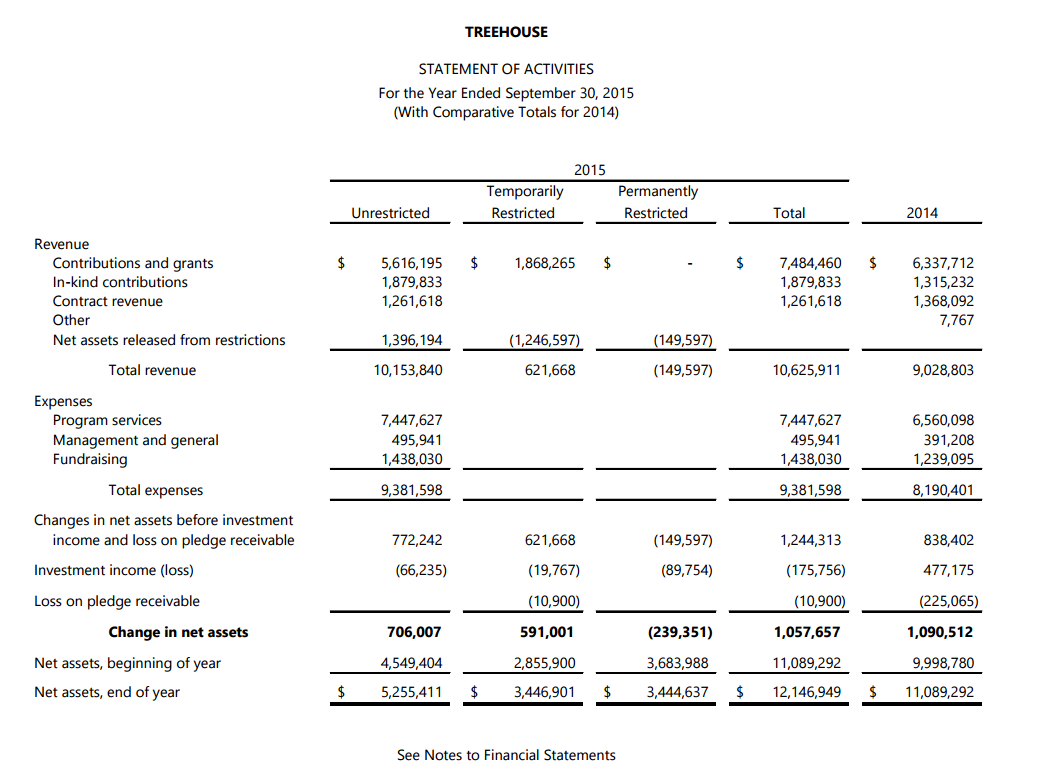

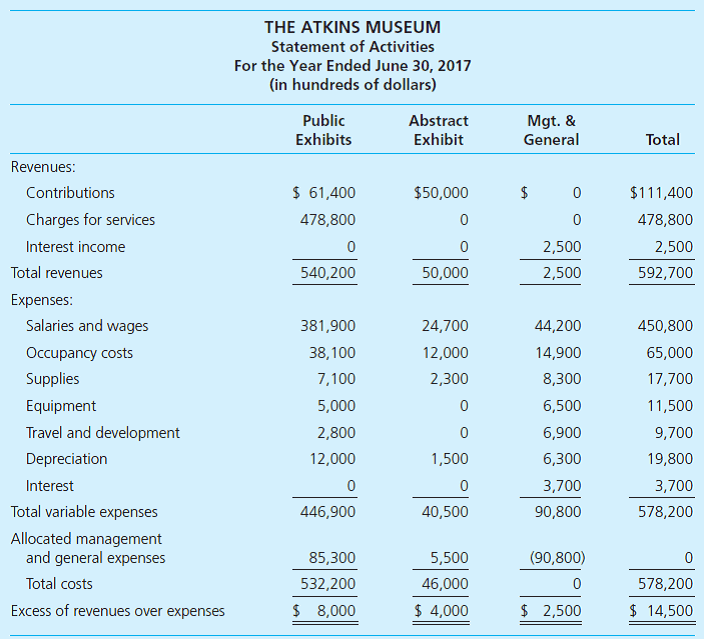

Presentation of Financial Statements of Not-for-Profit Entities all not-for-profit entities are now required to present the relationship between functional expenses such as major classes of program services and supporting activities and natural expenses such as salaries rent. A large net income usually tells us that something has gone right while a large loss indicates that something is amiss. Programs management and general and fundraising.

The purpose of a statement of functional expenses is to show how much of your money and time you spent on each of the categories mentioned above. Validate or refuse with just one click. Statement of Activities The Statement Of Activities is similar to the Income Statement businesses issue.

Validate or refuse with just one click. With Odoo Expenses youll always have a clear overview of your teams expenses. Presentation of Financial Statements of Not-for-Profit Entities.