Awesome Importance Of Common Size Statement

Where the traditional financial statements are used for the reporting purposes and to report the monetary position of the company the common size financial statements are used for the decision-making purposes.

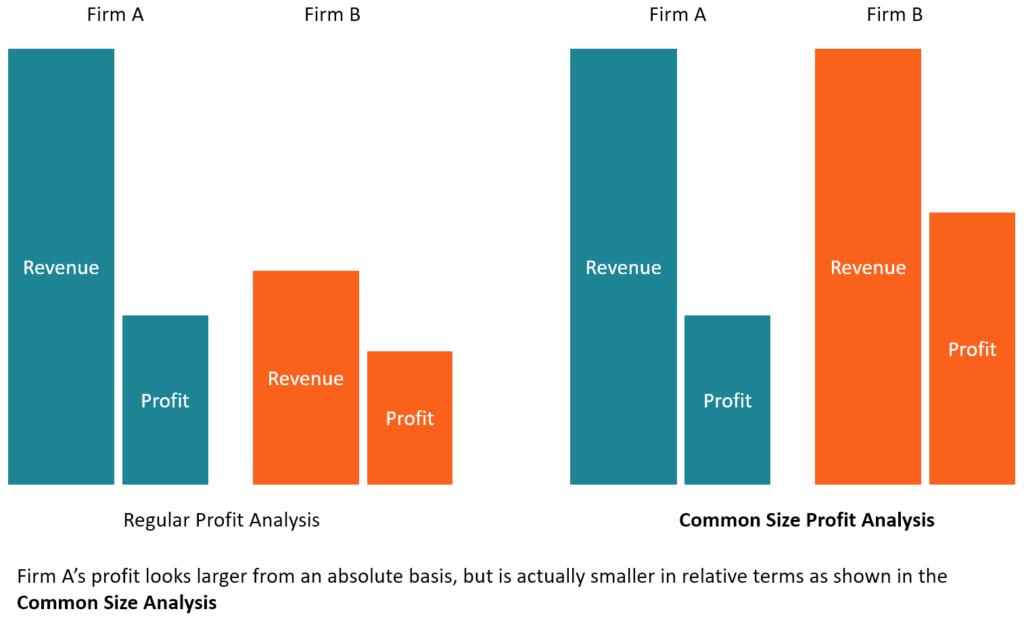

Importance of common size statement. The common-size income statement is generally used in financial statement analysis to compare companies that operate in the same or different industries or to compare time periods of the same firm. However these comparisons are worthless since companies operating in the industry can be small medium or big. Common size financial statements are different from the customary financial statements.

Common size or vertical analysis is a method of evaluating financial information by expressing each item in a financial statement as a percentage of a base amount for the same time period. Common size financial statement analysis which is also called a vertical analysis is just one technique that financial managers use to analyze their financial statements. This type of financial statement allows for easy analysis between.

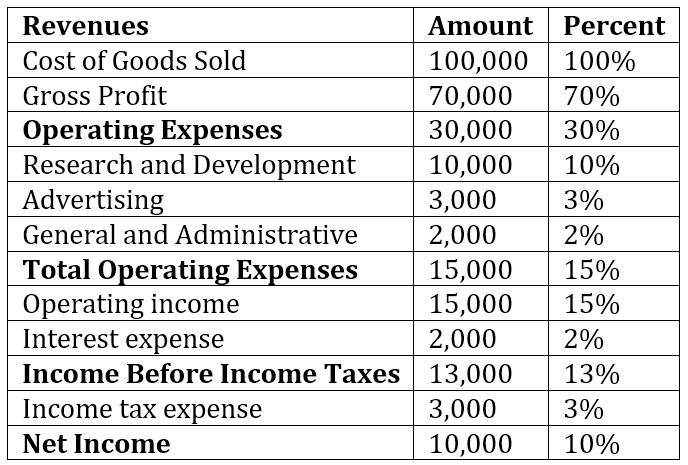

Common-size Statement helps the users of financial statement to make clear about the ratio or percentage of each individual item to total assetsliabilities of a firm. A common size income statement occurs when every line item on the income statement is shown as a percentage of sales. Importance of Common Size Analysis One of the benefits of using common size analysis is that it allows investors to identify drastic changes in a companys financial statement.

How to Common Size an Income Statement. This allows for easier comparison to other companies or across specific time periods. A common size income statement is an income statement in which each line item is expressed as a percentage of the value of revenue or sales.

Thus this technique helps in assessing the financial statements by considering each line item as a percentage of the base amount for that period. A common-size financial statement is simply one that is created to display line items on a statement as a percentage of one selected or common figure. This is helpful when not only looking at a single companys financial statements but also comparing multiple business of different sizes at one time.

Common-size analysis also called vertical analysis converts each line of financial statement data to an easily comparable or common-size amount measured as a percent. A common size financial statement displays items as a percentage of a common base figure total sales revenue for example. A common size financial statement displays line items as a percentage of one selected or common figure.

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)