Fine Beautiful Subordinated Loans In Balance Sheet

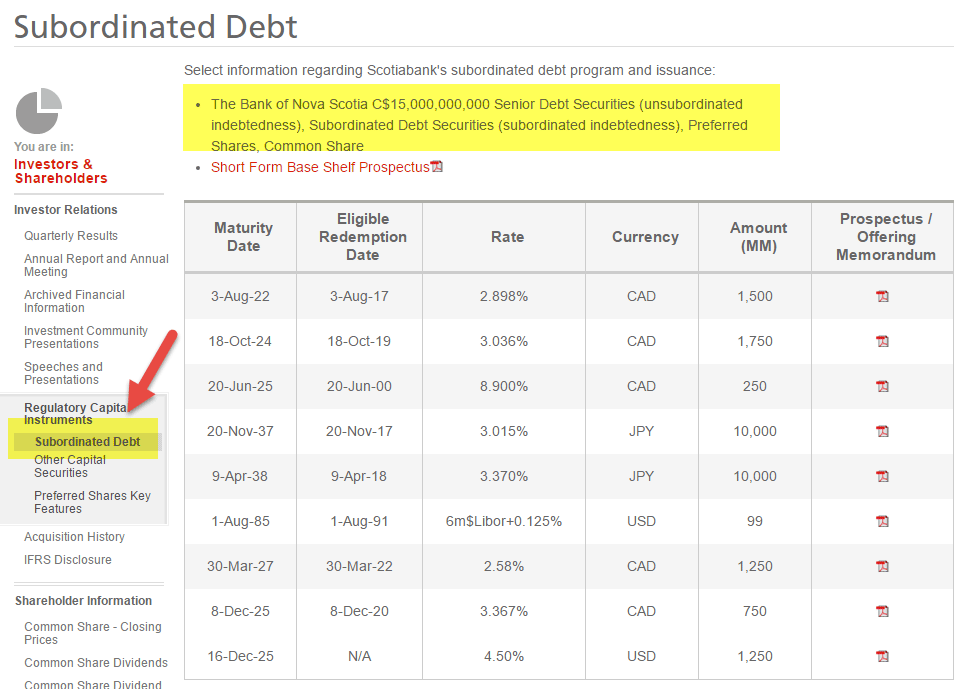

So what is a subordinated loan.

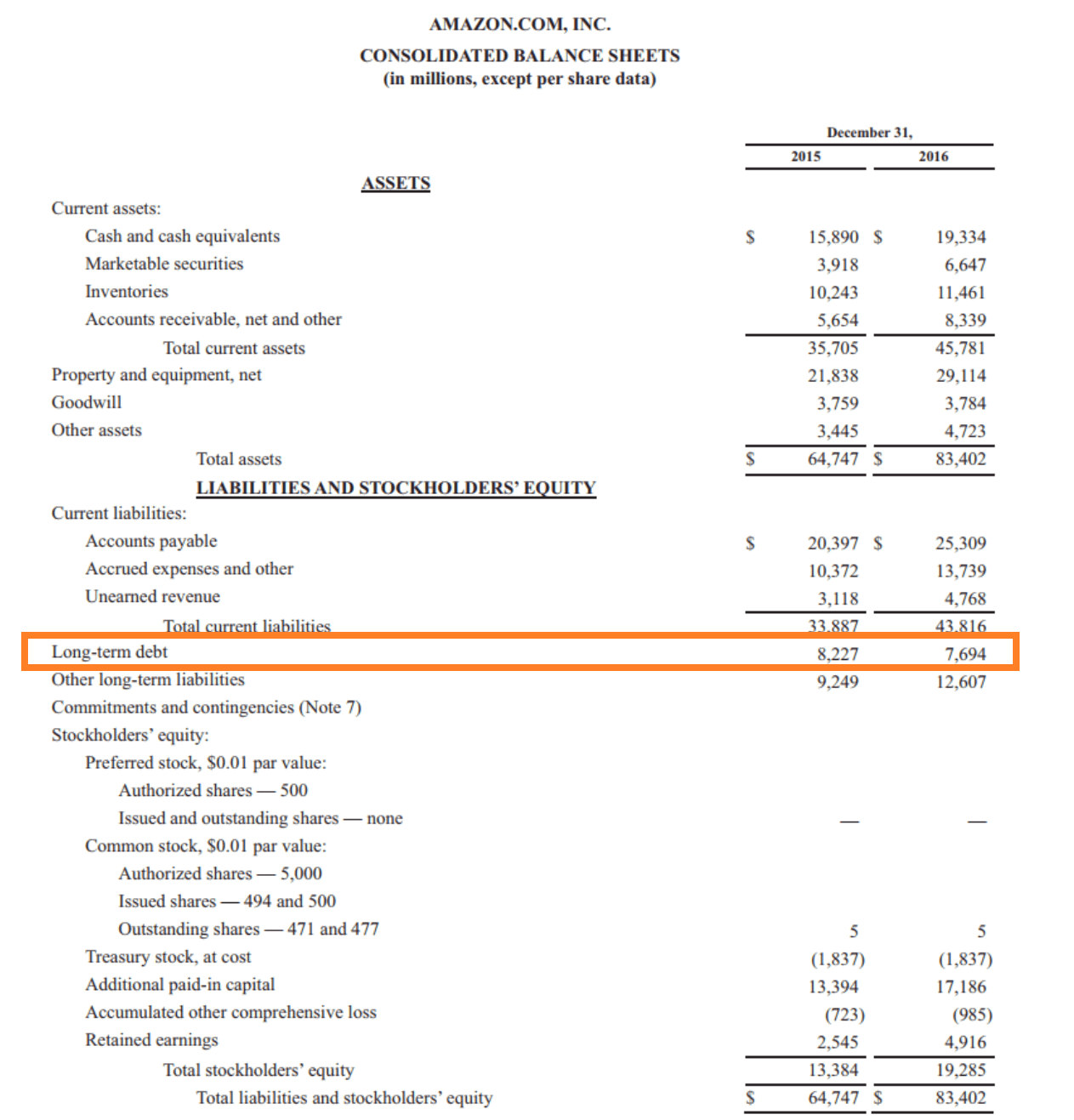

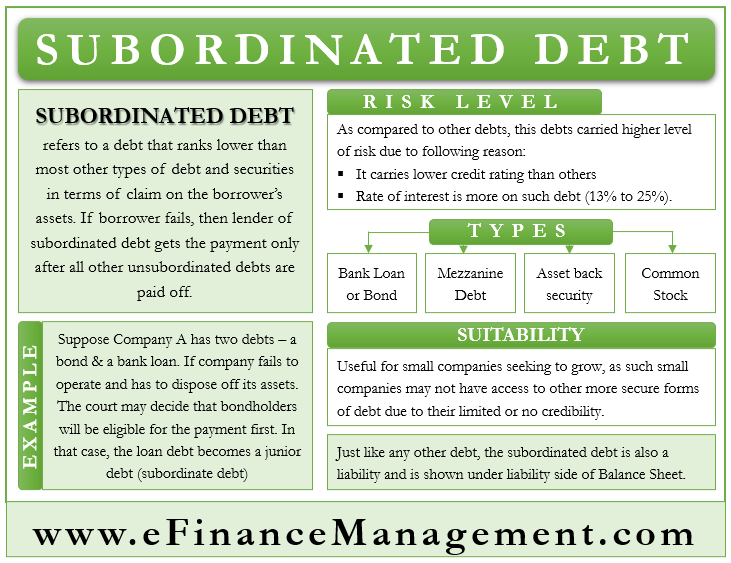

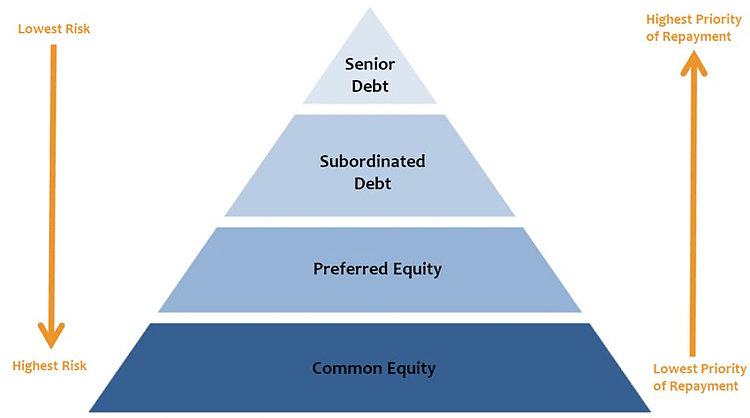

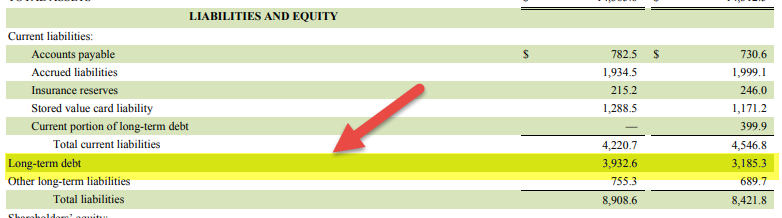

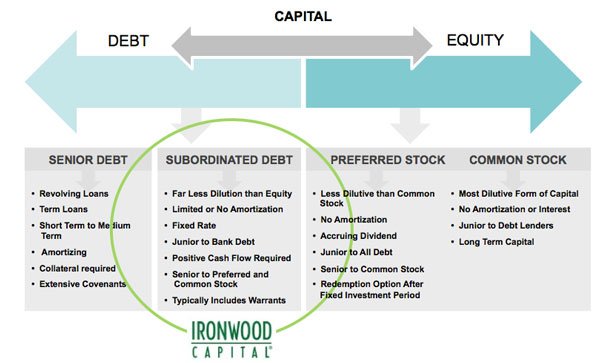

Subordinated loans in balance sheet. That means that in repayment terms the charge on the debt falls between normal loans and share. After this we show the junior debt on the balance sheet. Therefore like other debts and liabilities the subordinated debt will also be listed on the liabilities side of the balance sheet.

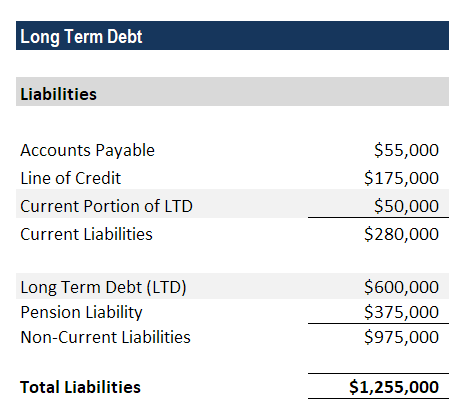

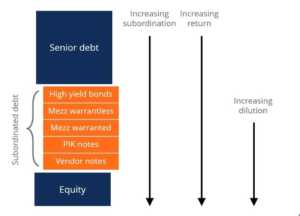

In case of problems the subordinated creditor will be reimbursed after the ordinary creditors but before the shareholders. Current liabilities are listed first. Lenders provide subordinated loans less-senior than traditional loans and they potentially receive equity interests as well.

Current liabilities are listed first on the balance sheet and then come long-term liabilities. Its also known as subordinated debt junior debt or a junior security while. There are three types of non-current liabilities only two of which are listed on the balance sheet.

A subordinated loan is debt thats only paid off after all primary loans are paid off if theres any money left. The subordinated loans shall be included in the balance sheet as a separate item and for the purposes of the Accounting Act they shall as a rule be considered as liabilities. Liquidity is the ease with which a firm can convert an asset into cash.

The latest management accounts including balance sheet profit and loss account and trial balance of the Borrower The last audited accounts of both the Borrower and the Lender. The cut-off time is 12 months so any debt with a longer repayment window becomes a long-term loan. The Supreme Courts finding that in effect a debtor may become insolvent before the point of no return is particularly important for borrowers and their lenders.

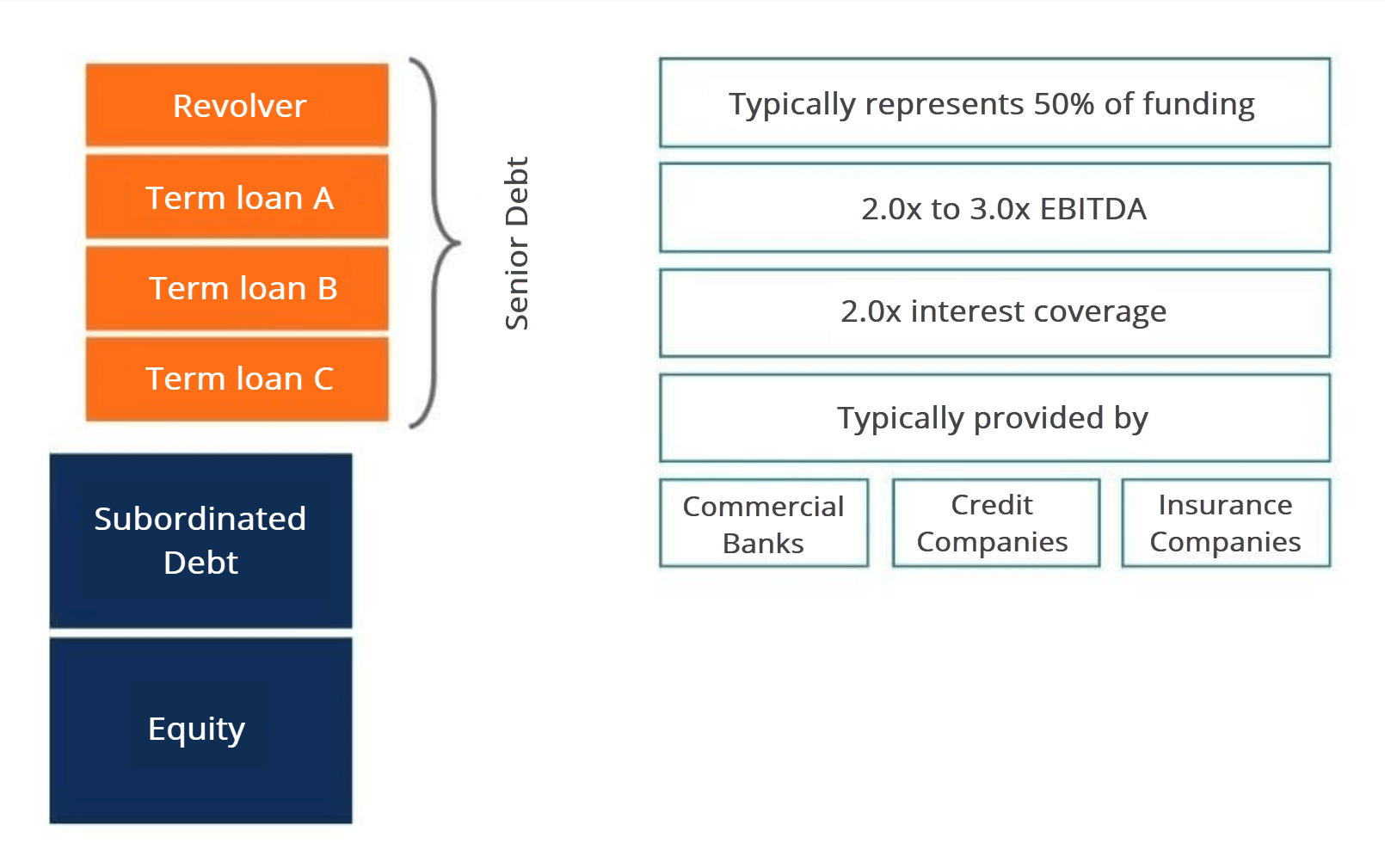

Typically senior debt is entered on the balance sheet next. Shareholder loans should appear in the liability section of the balance sheet. Typically senior debt is entered on the balance sheet next.