Sensational The Financial Statement That Summarizes The Changes In Retained Earnings

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

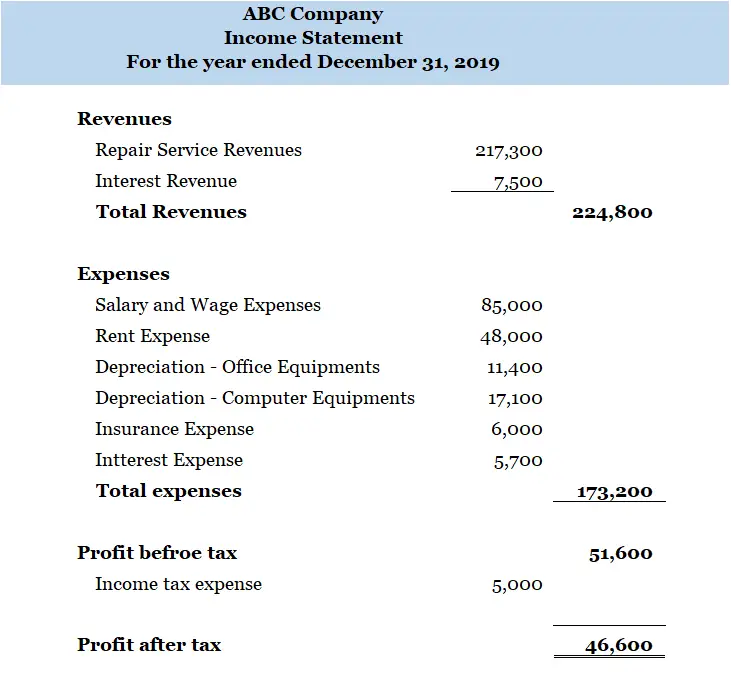

The statement of retained earnings is a financial statement prepared by corporations that details changes in the volume of retained earnings over some period.

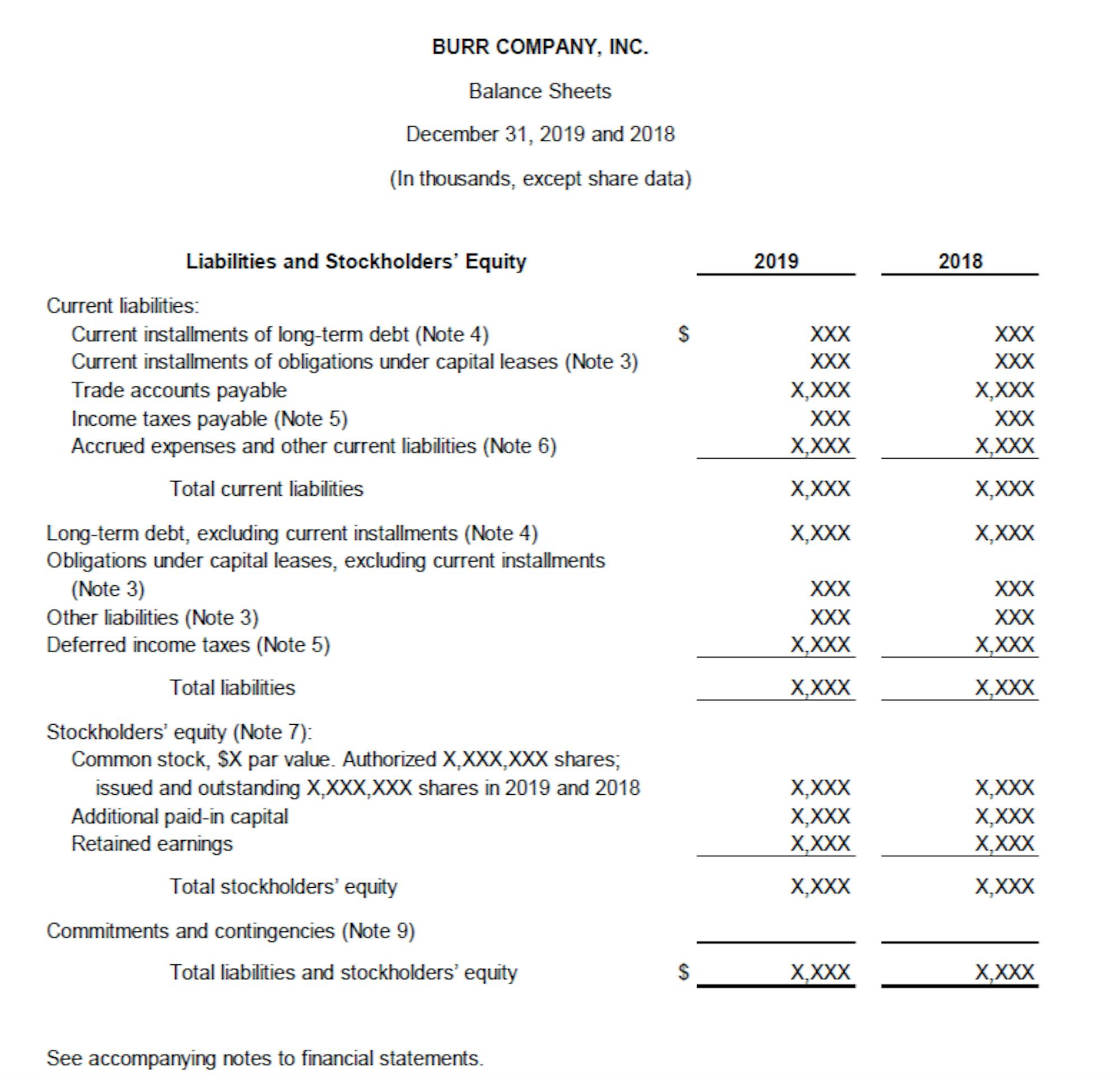

The financial statement that summarizes the changes in retained earnings. A summarizes the changes in retained earnings for a specific period of time. A month or a year. C reports the assets liabilities and stockholders equity at a specific date.

Dividends declared increase assets. This information may be included in the statement of changes in stockholders equity. Presents the revenues and expenses for a specific period of time.

Before retained earnings is adjusted on the income statement the business must first make all necessary adjustments to its expense and revenue accounts to record the activity of the financial period which includes adjustments for expenses that accumulate over time such as depreciation or accrued rent and salaries. Reports the changes in assets liabilities and stockholders equity over a period of time. The financial statement that reflects a companys profitability is the income statement.

B reports the changes in assets liabilities and stockholders equity over a period of time. Reports the assets liabilities and shareholders equity at a specific. The financial statement that summarises the changes in retained earnings for a specific period of time is the.

Retained earnings are profits held by. Statement of changes in retained earnings The financial statement that summarizes the changes during a fiscal period in retained earnings. A summary report called a statement of retained earnings is also maintained outlining the changes in RE for a specific period.

Ad Best-in-Class Data Marketplace Connected Symbology for Financial Professionals. Statement of cash flows. Summarizes the changes in retained earnings for a specific period of time.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)