Heartwarming Cash Flow Reconciliation Indirect Method

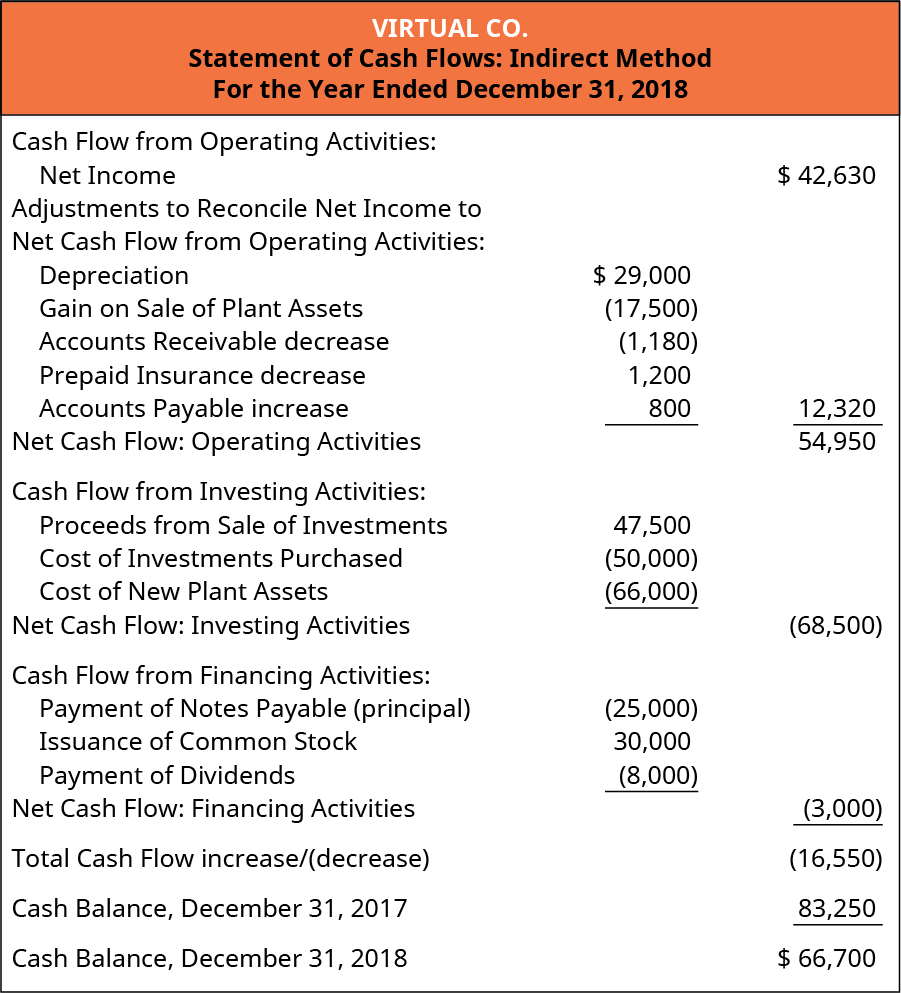

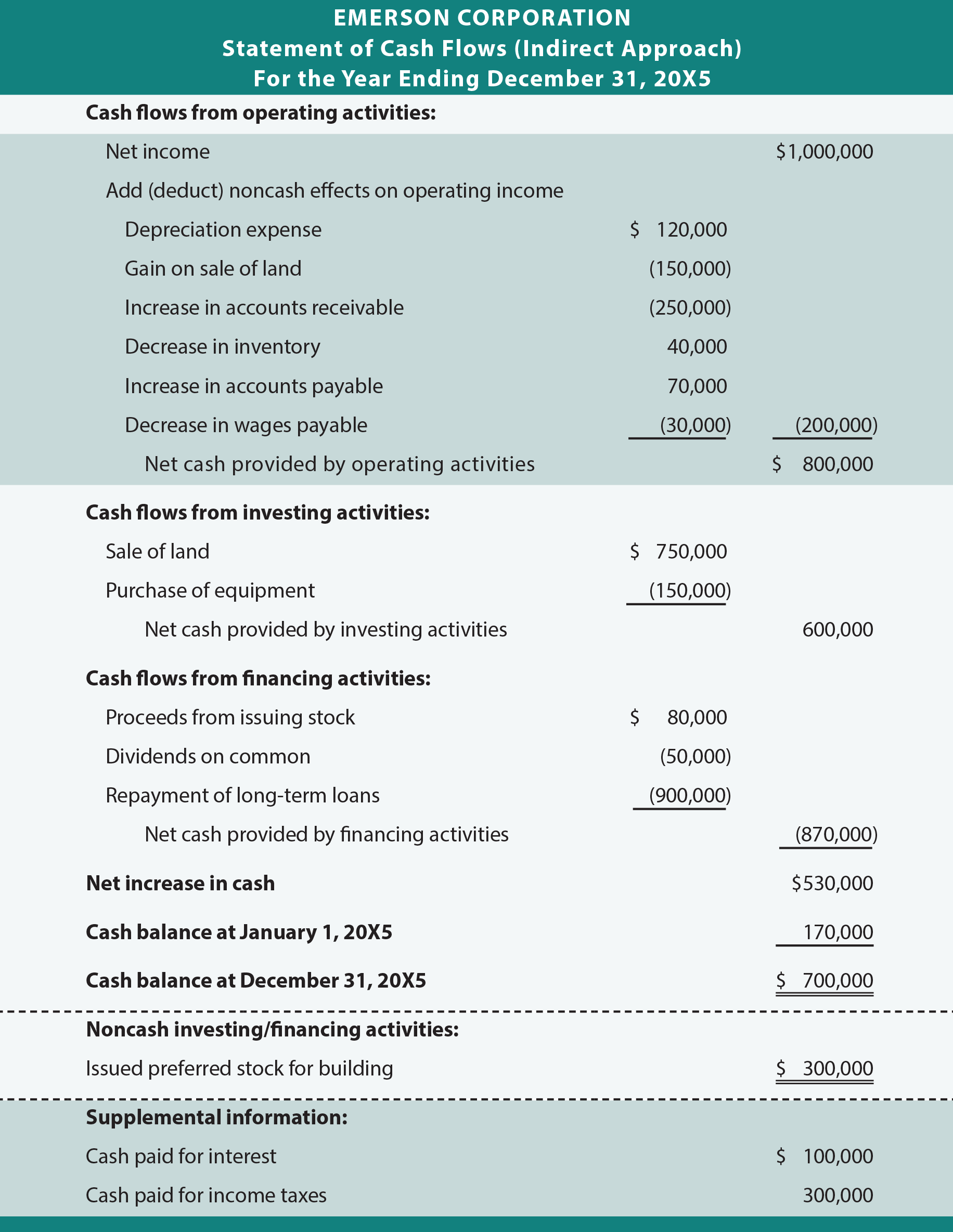

Order to understand the indirect method of statement of cash flows ie the reconciliation between accrual- and cash-basis accounting methods.

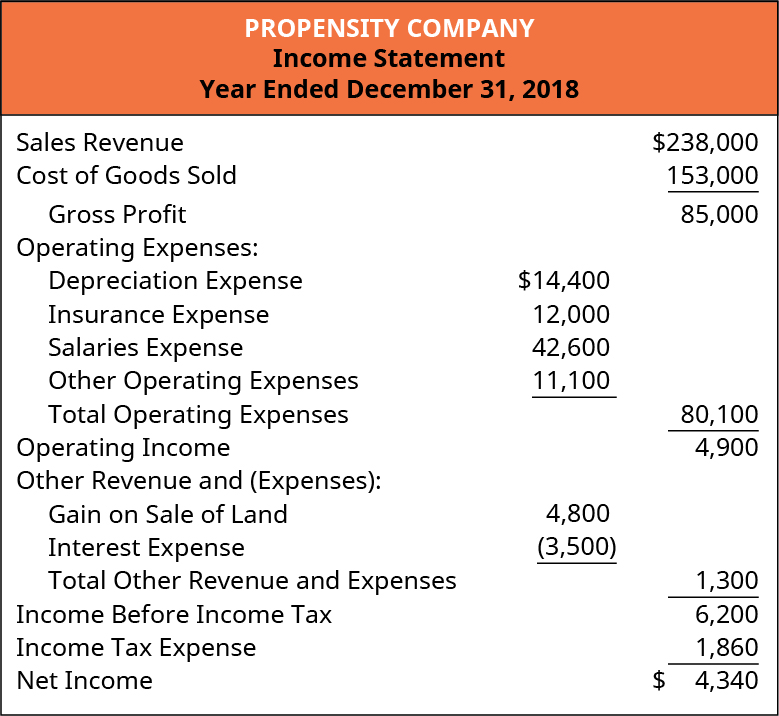

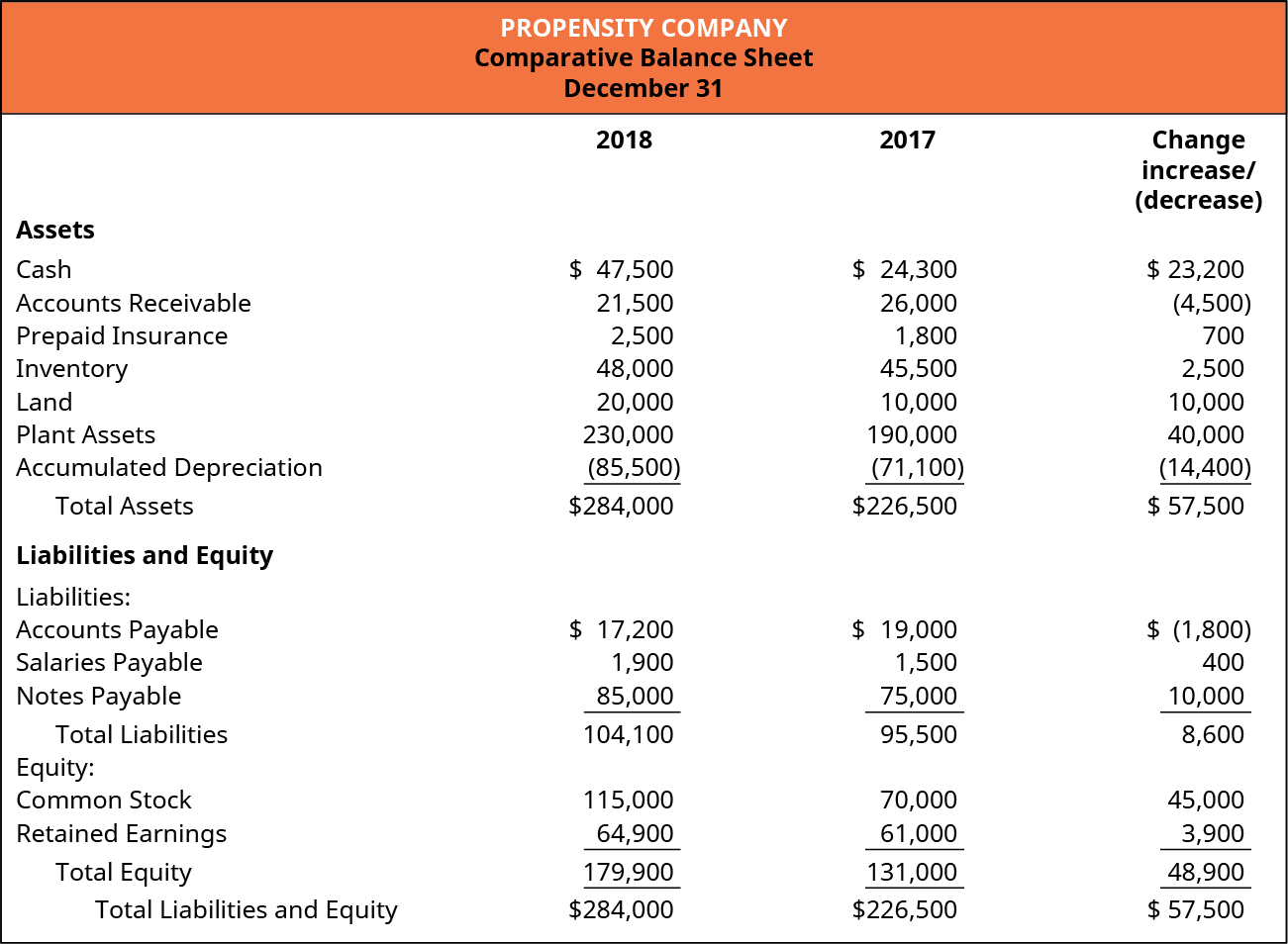

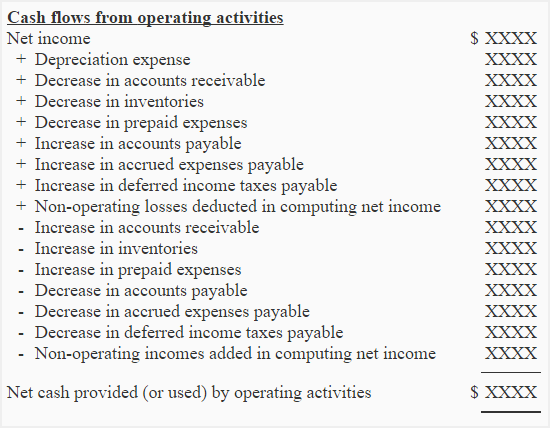

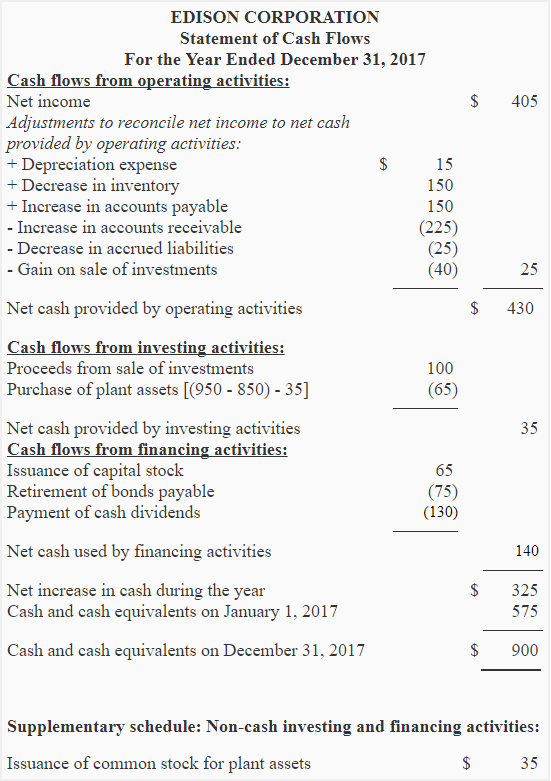

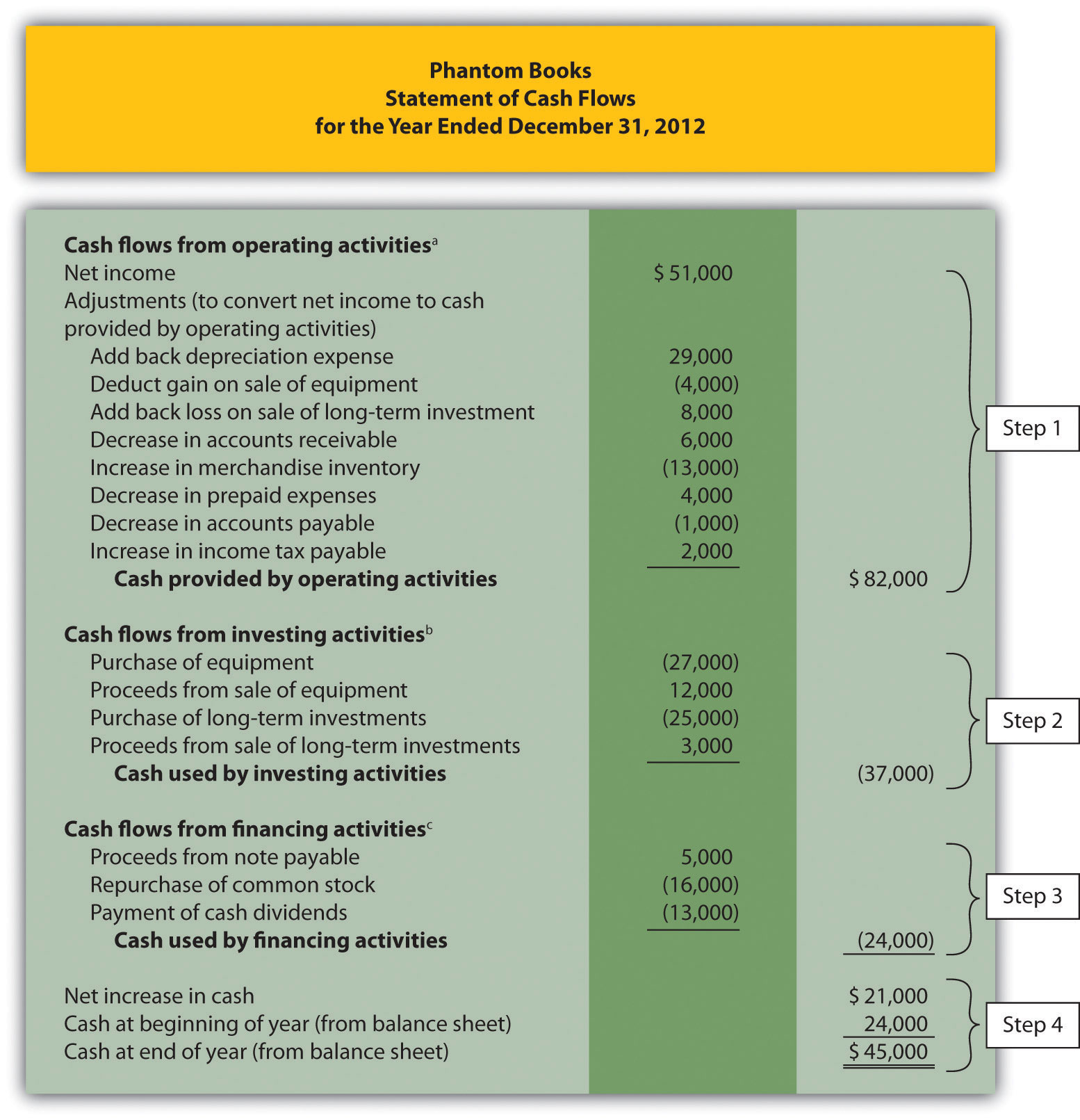

Cash flow reconciliation indirect method. An illustration of an NFP cash flow statement that reports operating cash flows using the indirect method. These adjustments include deducting realized gains and other adding back realized losses to. All adjustments made to reconcile the change in net assets to the net cash provided by or used in operating activities should be clearly identified as reconciling items.

With the indirect cash flow you are reconciling back to cash. Under the direct method reconciliation occurs when a. Multiple levels of adjustments are required to reconcile accrual-based net income to cash flows from operating activities.

In the indirect method we dont see these items broken down. Information for indirect cash flow is simple to compile as it comes directly from the income statement and balance sheet. If you are a QuickBooks user QuickBooks generates their cash flow reports using the indirect method.

This method is also known as reconciliation method and starts with net income and converts it to net cash flow from operating activities. The statement of cash flow is part of a businesss financial report typically completed once a year. This is a bit complicated and requires a separate reconciliation like indirect cash flow and it is used to prove the operating activities are correct.

When learning the indirect method students are shown how to add subtract non-cash expenses and make changes in certain balance sheet accounts to from net income and they are provided with. The Basics Cash flow from operating activities identifies the movement of the primary revenue-generating activities for the reporting period. Under indirect method also known as reconciliation method we convert net operating income or loss to net cash provide or used by operating activities during the year.

Preparing the operating section of statement of cash flows by the indirect method starts with net income from the income statement and adjusts for items that affect cash flows differently than they affect net income. Most businesses and firms prefer the cash flows indirect presentation. The indirect cash flow method reconciles the accrual-based accounting net cash flow with the actual cash flows from the companys operating activities showing the difference between the companys cash holding position and its stated profitability.