Brilliant Common Size Analysis Balance Sheet Income Statement Statement Of Owners Equity And Balance Sheet Example

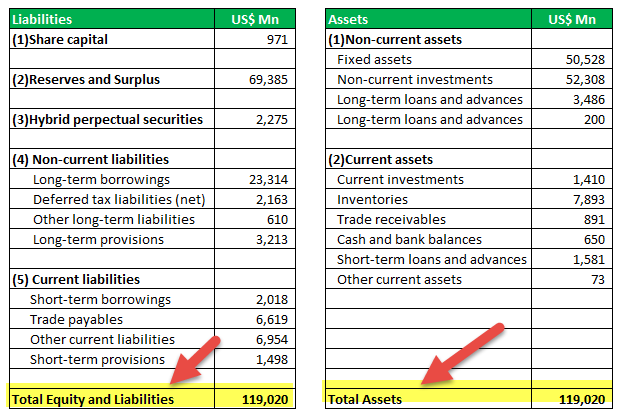

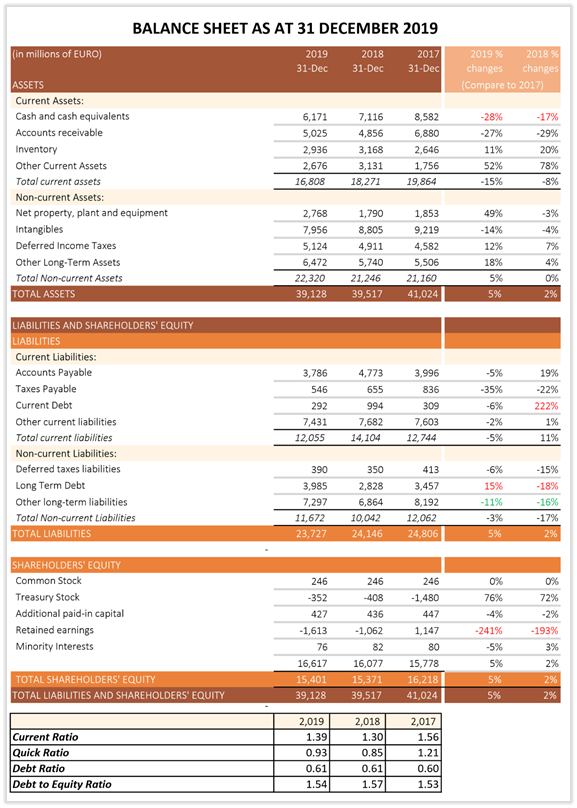

The balance sheet also referred to as the statement of financial position discloses what an entity owns assets and what it owes liabilities at a specific point in time.

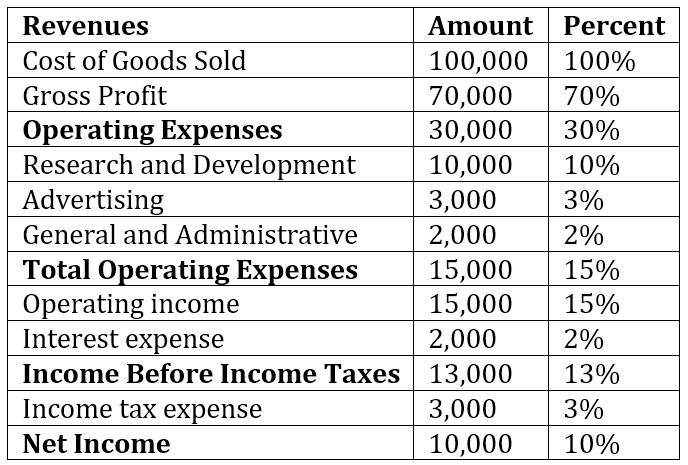

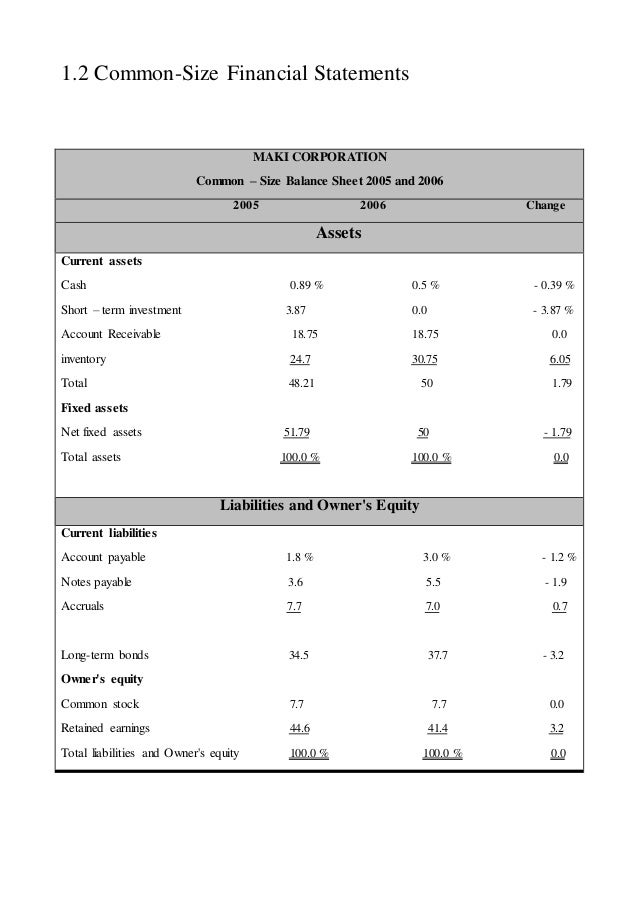

Common size analysis balance sheet income statement statement of owners equity and balance sheet example. Remember on the balance sheet the base is total assets and on the income statement the base is net sales. Typically investors will look at a companys common size balance sheet and common size income statement. All values USD Millions.

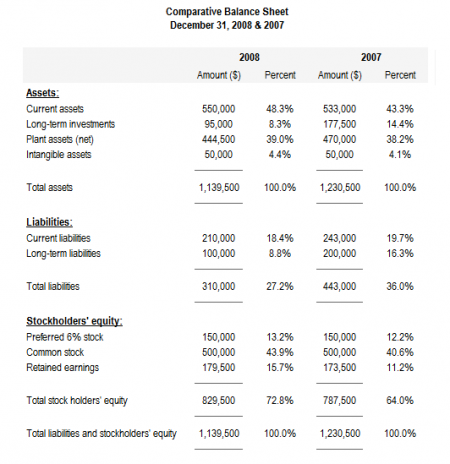

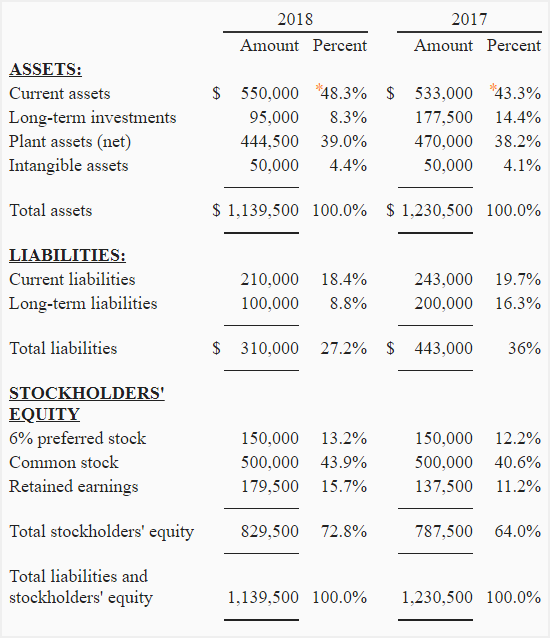

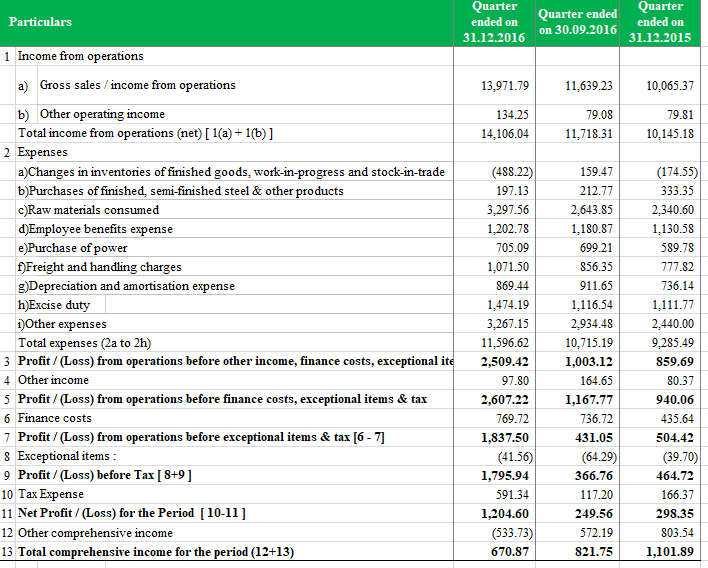

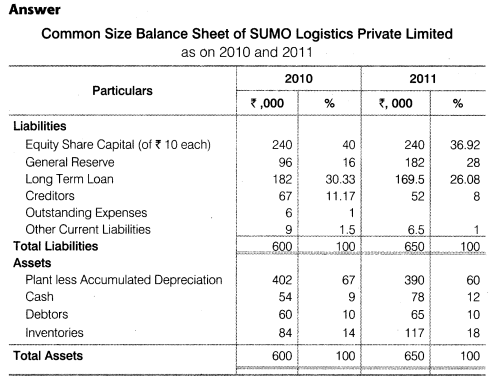

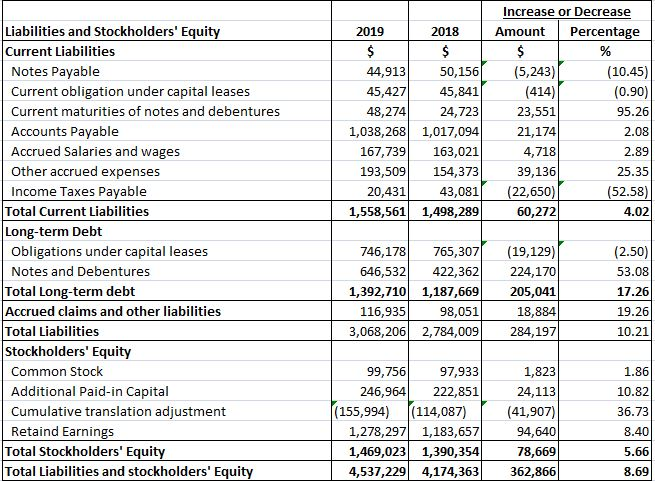

Get the annual and quarterly balance sheet of Starbucks Corporation SBUX including details of assets liabilities and shareholders equity. 2020 2019 2018 2017 2016 5-year trend. Vertical analysis also known as common-size analysis is a popular method of financial statement analysis that shows each item on a statement as a percentage of a base figure within the statement.

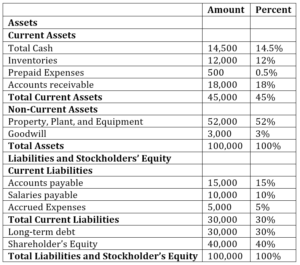

To conduct a vertical analysis of balance sheet the total of assets and the total of liabilities and stockholders equity are generally used as base figures. These three core statements are. 10 Prepare an Income Statement Statement of Owners Equity and Balance Sheet.

The key differences between the two reports include. One of the key factors for success for those beginning the study of accounting is to understand how the elements of the financial statements relate to each of the financial statements. A common size balance sheet allows for the relative percentage of each asset liability and equity account to be quickly analyzed.

Equity is the owners residual interest in the assets of a company net of its liabilities. ST Debt Current Portion LT Debt. What is Common Size Analysis.

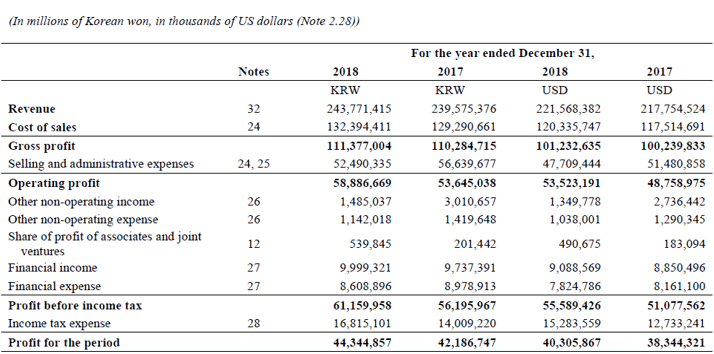

The video showed an example using the balance sheet so we will look at Synotech Incs income statement with common-size. The income statement reports on financial performance for a specific time range often a month quarter or year. Any single asset line item is compared to the value of total assets.