Unique Modified Cash Basis Balance Sheet Example Accounting 101

Not used for the cash basis or modified cash basis since these items are charged to expense.

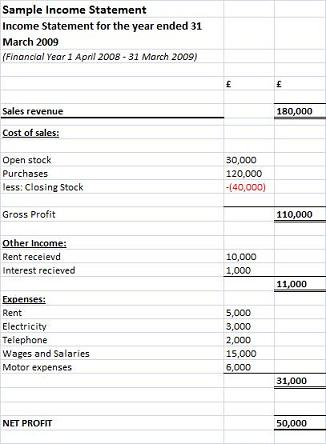

Modified cash basis balance sheet example accounting 101. One credit and one debit. Accrual basis accounting recognizes revenue upon billing and recognizes expenses upon payables being booked into the software system. Under the cash basis you recognize a transaction when there is either incoming cash or outgoing cash.

Small businesses are not required to choose one accounting method and always follow it. Under that basis revenues and the related assets are recognized when received rather than when earned and expenses are recognized when paid rather than when obligation is incurred. Modified accrual accounting follows cash-basis accounting to report short-term events.

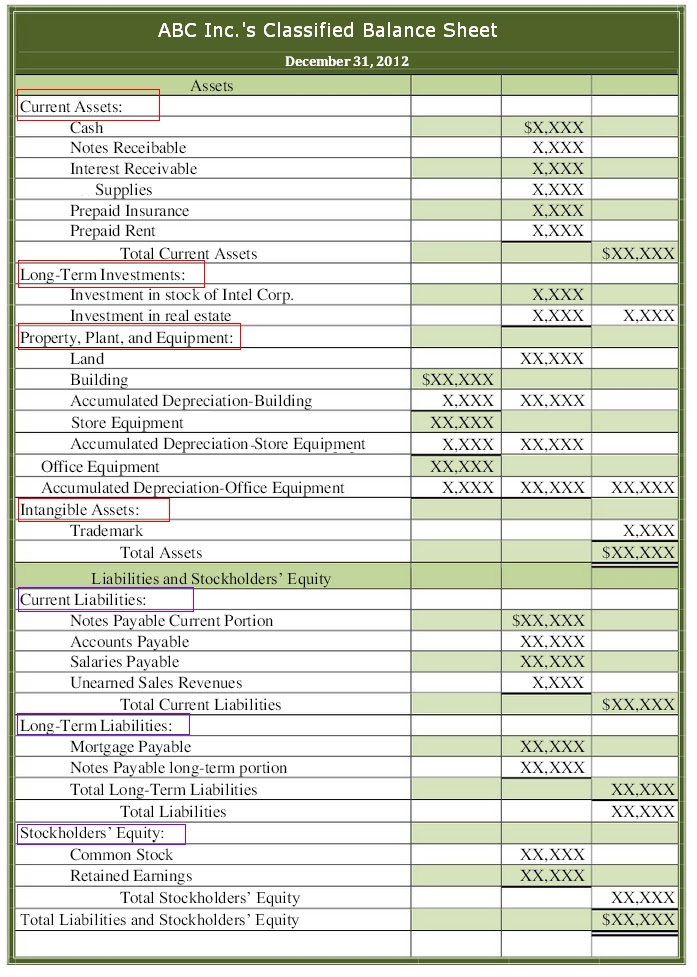

The economic events that affect the items are regarded as short-term events. Chapter 2 The Cash Basis of Accounting 53 tion the set of rules depends upon whether the business uses the cash basis or the ac-crual basis of accounting. Several asset and liability accounts are generally absent on a cash-basis balance sheet.

If an item is invoiced and the invoice is paid it will remove the item from the list usually but not alwaysIf an item is invoiced and the invoice is still open it will not remove the item from the list usually but not always. Cash-basis vs Accrual Accounting. Choosing the right method for your.

The events are recorded when the cash balance is changed. If you were using the cash-basis method you would record an expense when you paid a bill even though that might not necessarily be the same time that you incurred the expense. However the reasons for a given choice can vary based on business size and needs.

This cash basis accounting example shows two transactions. Cash-basis accounting recognizes revenue and expenses based on cash inflows and outflows. The balance sheet contents under the various accounting methodologies are.