Beautiful Horizontal Analysis Of Income Statement Formula

For example you start an advertising campaign and expect a 25 increase in sales.

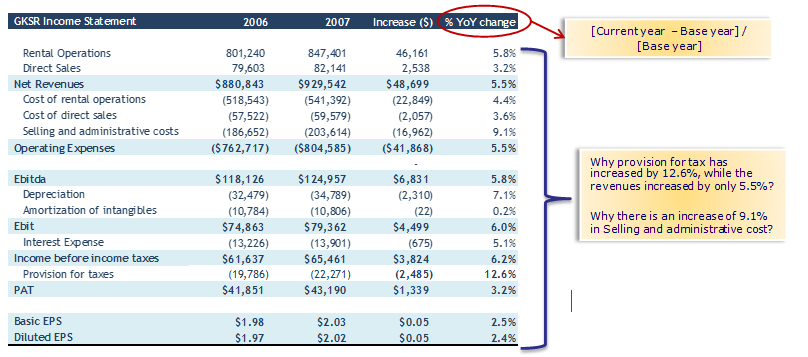

Horizontal analysis of income statement formula. Step 1 Perform the horizontal analysis of income statement and balance sheet historical data. Incomes Expenses and Taxes represent. Trend Analysis for Income Statement Items using Excel.

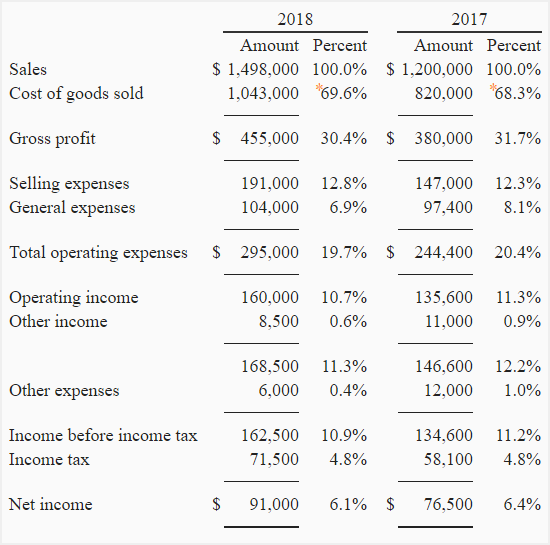

For example in the income statement below the difference in revenue between 2017 and 2018 is 13000 so you would use the following horizontal analysis formula to. The formula for horizontal analysis can be deducted the amount in the base year from the amount in the comparison year. Horizontal analysis Amount in Comparison Amount in the base yearAmount in a base year 100.

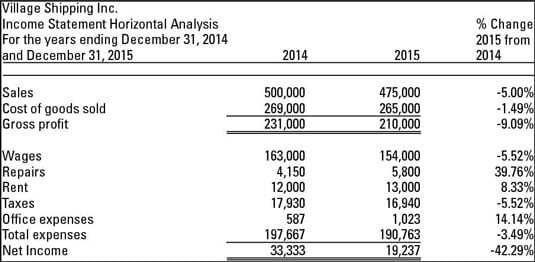

Horizontal analysis involves the computation of amount changes and percentage changes from the previous to the current year. An alternative format is to simply add as many years as will fit on the page without showing a variance so that you can see general changes by. Step 2 Based on the YoY or QoQ growth rates you can make an assumption about future growth rates.

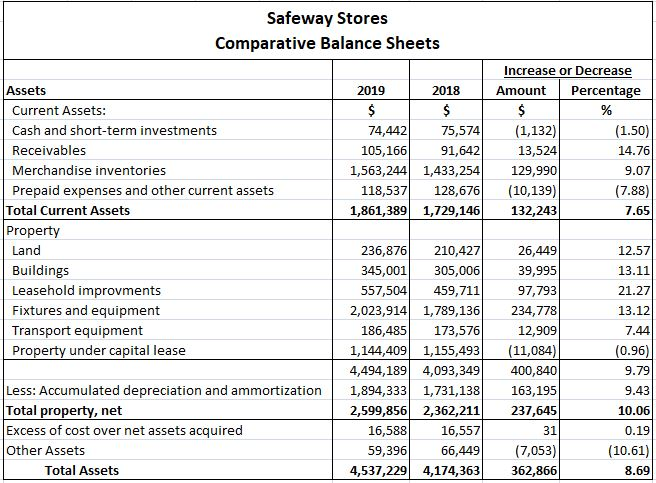

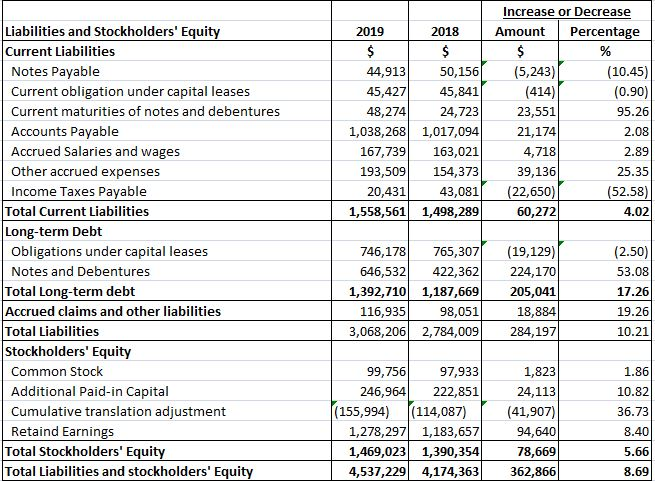

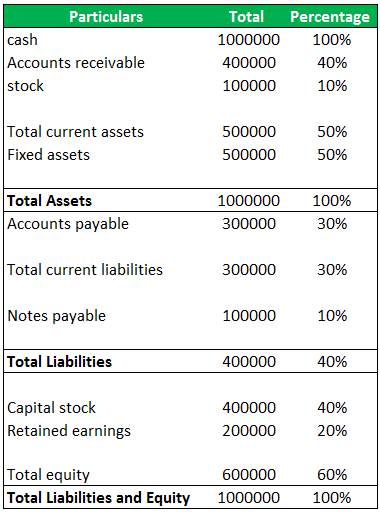

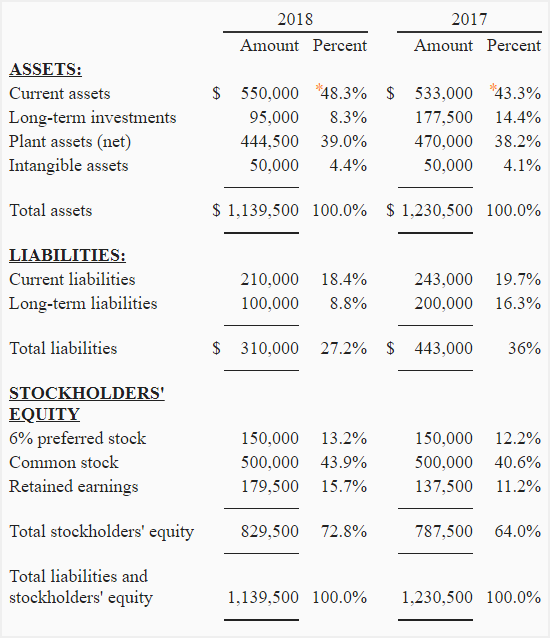

Retained Earnings Statement For the Years Ended December 31 Increase or Decrease during 1999 2003 2002. 6 HORIZONTAL ANALYSIS OF BALANCE SHEET. 8 HORIZONTAL ANALYSIS OF RETAINED EARNINGS STATEMENT QUALITY DEPARTMENT STORE INC.

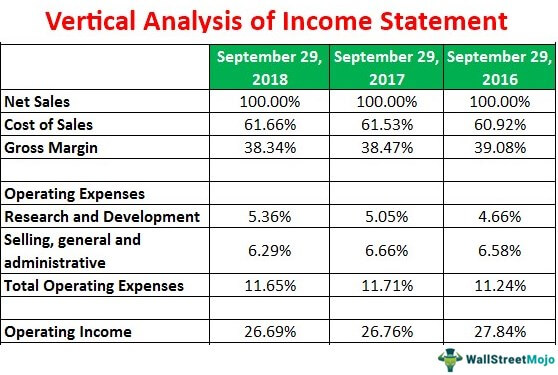

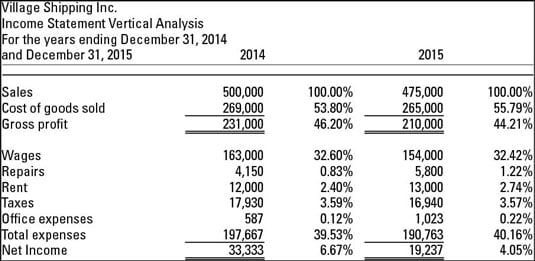

Simply put this type of analysis consists of comparing the indicators of the accounting reports with indicators of previous periods. Horizontal Analysis is very useful for Financial Modeling and Forecasting. Horizontal analysis of the income statement is usually in a two-year format such as the one shown below with a variance also shown that states the difference between the two years for each line item.

Horizontal analysis is an approach used to analyze financial statements by comparing specific financial information for a certain accounting period with information from other periods. Analysts use such an approach to analyze historical trends. Income Statement Horizontal analysis is the technique of evaluating financial statements analysis to know the changes in the amounts of corresponding items over a period.