Top Notch Ifrs 9 Investment In Subsidiary

An inter-company loan is outside IFRS 9s scope and within IAS 27s scope only if it meets the definition of an equity instrument for the subsidiary for example it is a capital contribution.

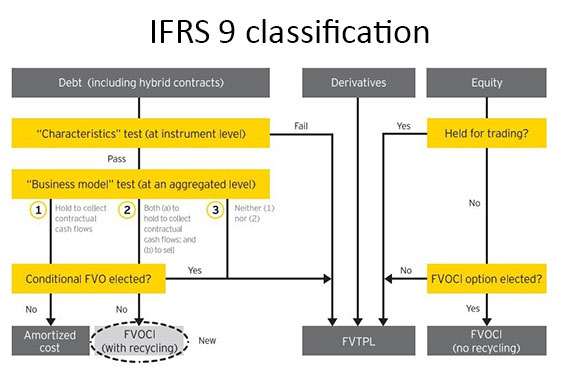

Ifrs 9 investment in subsidiary. Rather IAS 27 applies to such investments. When to recognize a financial instrument. The investment funds financial statements and thus would be exempt from IFRS 9 apply IFRS 9 to its investment in the fund.

The Committee concluded that an entity would account for the cost of the. The holder of such an investment in a fund is required to apply IFRS 9 in its entirety to the investment unless the investment fund is a subsidiary associate or joint venture. An intercompany loan is outside IFRS 9s scope and within IAS 27s scope only if it meets the definition of an equity instrument for the subsidiary for example it is a capital contribution.

Holds an initial investment in another entity investee. IFRS 9 para 21d. An inter-company loan is outside IFRS 9s scope and within IAS 27s scope only if it meets the definition of an equity instrument for the subsidiary for example it is a capital contribution.

When an entity becomes an investment entity it accounts for an investment in a subsidiary at fair value through profit or loss in accordance with IFRS 9. IFRS 9 does NOT deal with your investments in subsidiaries associates and joint ventures look to IFRS 10 IAS 28 and related. Inter-company financings that in substance form part of an entitys investment in a subsidiary are not in IFRS 9s scope.

A capital contribution ie. IFRS 9 generally is effective for years beginning on or after January 1 2018 with earlier adoption permitted. Subsidiary is an entity which is controlled by another entity.

Acquisition of subsidiary 112 34. Rather IAS 27 applies to such investments. This is particularly the case if settlement of.