Outrageous Impairment Loss Double Entry

Give the double entries to adjust the allowance for impairment of TR.

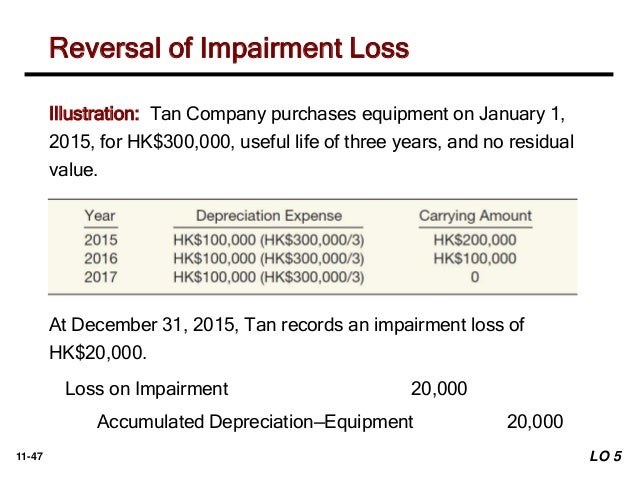

Impairment loss double entry. Impairment loss is recognized immediately in PL unless the asset is carried at revalued amount Thus entries would be. In the first case we would. 1Net selling price Fair value market value - cost to sell the asset.

That is because it results in a decrease. To come to by way of increase. To be added as increase profit or damage especially as the produce of money lent.

I have a client that invested in a couple of LLP tax schemes the initial investment was recorded at cost in the accounts but were now a couple of years down the line HMRC are now finally enquiring into the scheme and it appears reasonable to revalue or carry out an impairment review effectively reducing. Reduce the carrying amount of any goodwill allocated to the CGU. The classification may depend on the companys preferences.

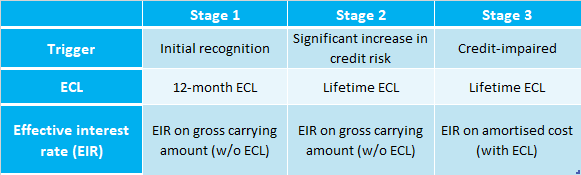

On the other hand it also affects the Balance Sheet of the company. Recording decrease in provision for doubtful debts. If there is objective evidence that an impairment loss on the financial assets has been incurred the loss must be recognised in profit or loss.

If the recoverable amount of CGU is lower than its carrying amount then an entity shall recognize the impairment loss. The debit entry to the equity method income account reflects the share of the loss recognized by the investor. Recoverable amount is higher of.

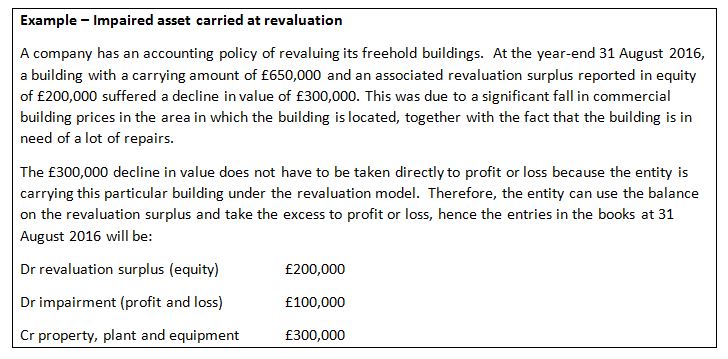

Dr Revaluation surplus BS account. Allocate remaining impairment loss to the other assets of the unit pro rata on the basis of. An impairment loss is recognized through a journal entry that debits Loss on Impairment debits the assets Accumulated Depreciation and credits the Asset to reflect its new lower value.