Ideal Cash Flow Impact Analysis

Cash Flow Analysis Planning Cash flow is one of the biggest areas that impact an organizations ability to reopen recover and thrive in our new normal Managing cash flow is one of the critical strategies for any healthcare organization large or small navigating our current crisis.

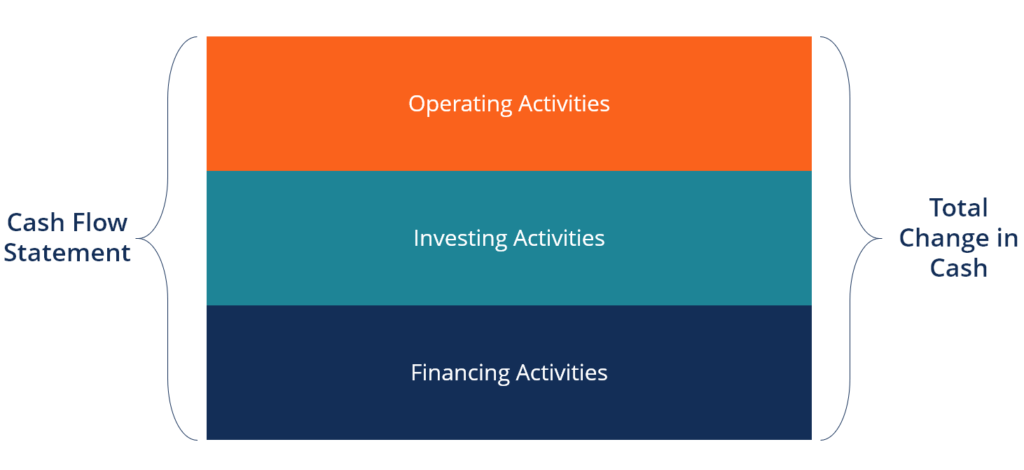

Cash flow impact analysis. Financing cash flows typically include cash flows associated with borrowing and repaying bank loans and issuing and buying back shares. Calculating a cash flow formula is different from accounting for income or expenses alone. The discounted cash flow approach is an intrinsic value approach that determines the value of the company by computing the present value of cash flows over the life of the company.

Cash flow from financing activities are activities that result in changes in the size and composition of the equity capital or borrowings of the entity. Narrowing or even closing cash flow gaps is the key to cash flow management. It shows how the company is generating its money where it is coming from and what it means about the overall value of the company.

Below is an example of Amazons operating cash flow from 2015 to 2017. Learn more with detailed examples in CFIs Financial Analysis Course. Cash Flow is the net amount of cash and cash-equivalents being transferred in and out of a company.

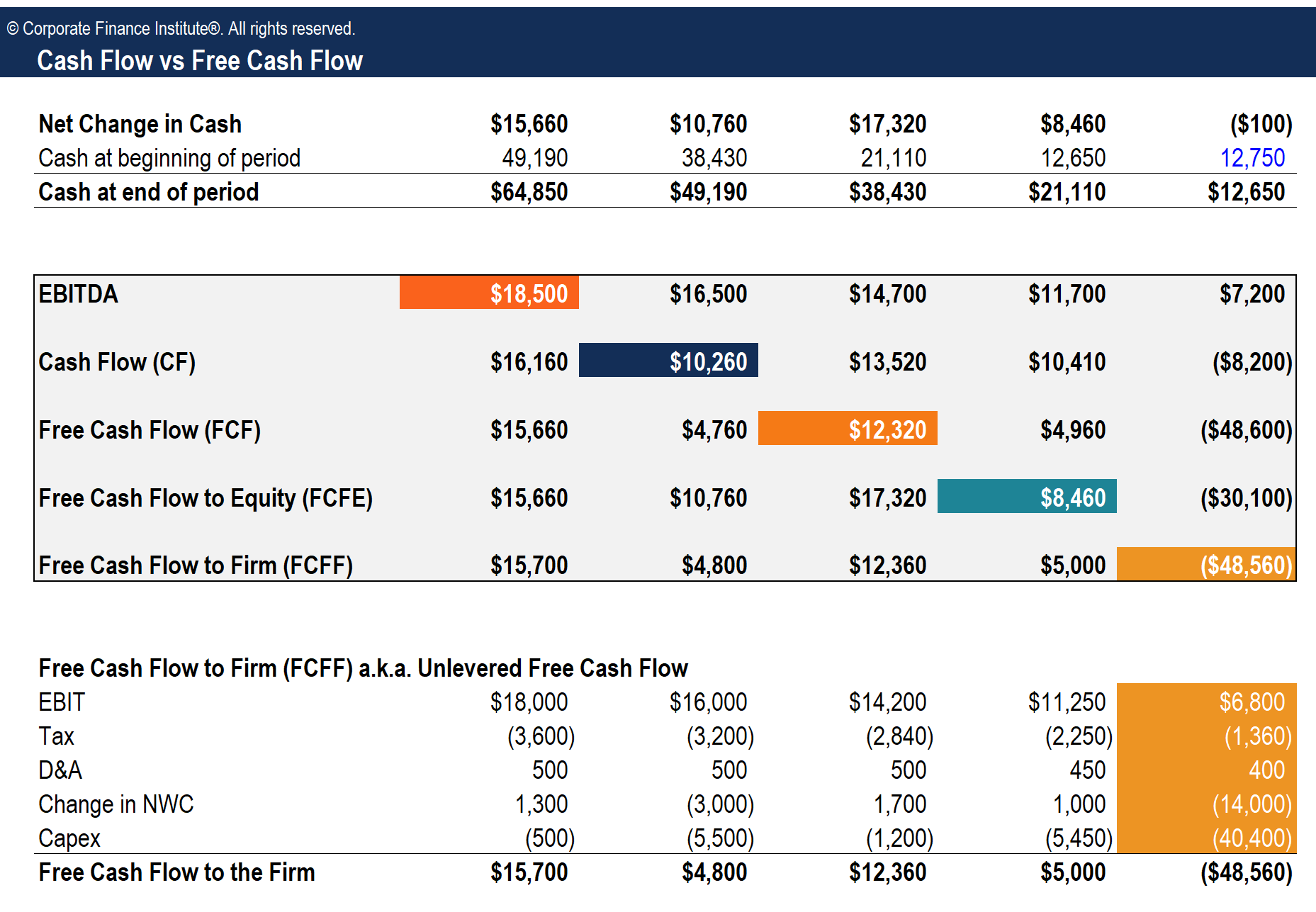

Look closely at the image of the model below and you will see a line labeled Less Changes in Working Capital this is where the impact of increasesdecreases in accounts receivable inventory and accounts payable impact the unlevered free cash flow. Global Cash Flow Market is expected to perceive a decent rise in income in the upcoming period. Cash flow analysis Cash flow analysis is the evaluation of a companys cash inflows and outflows from operating financing and investing activities.

To properly manage your businesss cash flow you must first analyze the components that affect the timing of your cash inflows and cash outflows. Cash Flow from Operations Net Income Non-Cash Items Changes in Working Capital. Essentially they help business owners understand where money is coming from where its going and how long their business can persist under certain circumstances.

As such other activities ie those not within the core business operations of a company from which the company generates income must be scrutinized deeply in order to reflect a more appropriate FCF value. Preparing Your Cash Flow Statement. Cash Flow from Operations Example.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)