Perfect Interest On Bank Overdraft In Profit And Loss Account

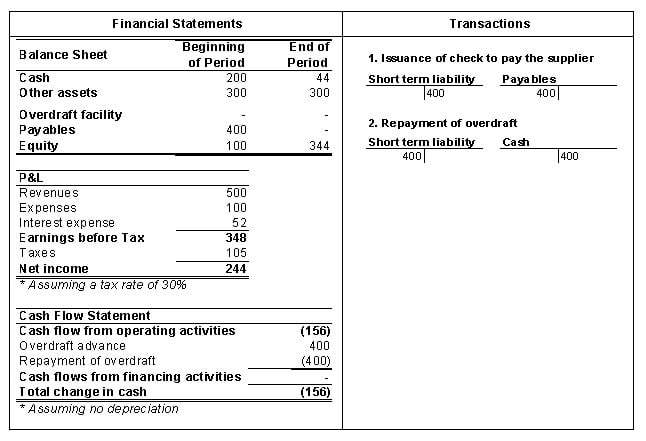

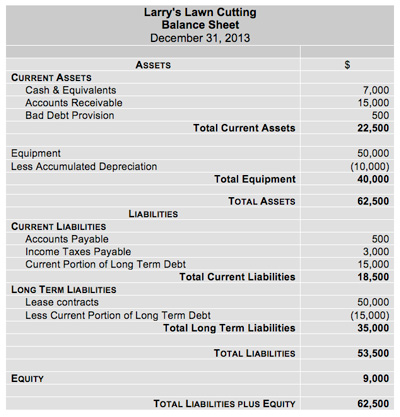

It does not have a place on the Balance Sheet.

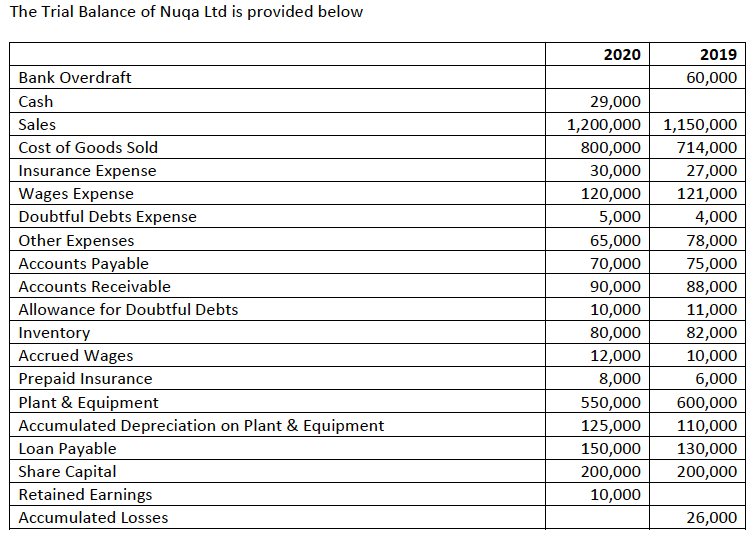

Interest on bank overdraft in profit and loss account. The rate of interest is generally higher than the rate of interest of Cash Credit. In other words if a company paid 20 in interest on its debts and earned 5 in interest from its savings account the income statement would only show Interest Expense - Net of 15. 2 Interest on Factroing to Interest payable.

1 Overdraft fee - Bank charges and therefore admin expenses. This facility allows the current account holder to withdraw money even when the account balance reaches zero. The financial expenses that include interest on the loan loan interest on bank overdraft bank charges etc.

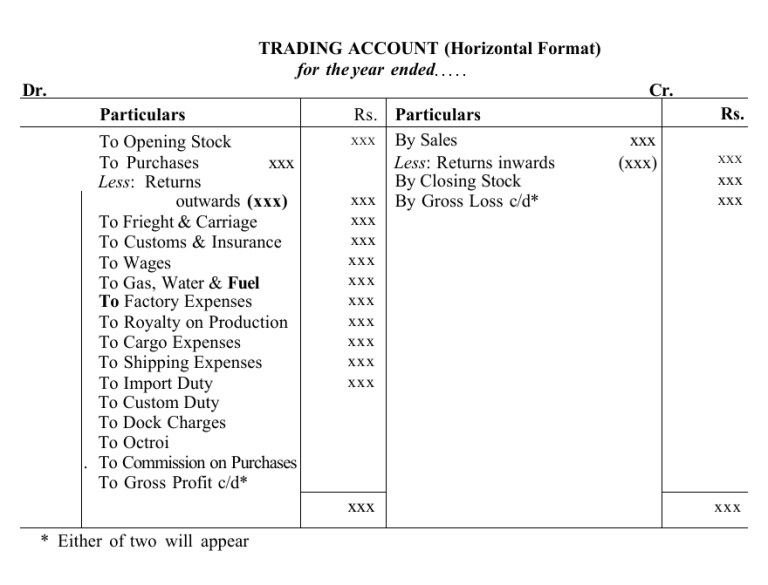

Ad Find Bank Account Interest. Are debited in profit and loss accountThese expenses are incurred for the steady supply of financial necessary for the business. Interest of an overdraft will be charged to the debit side of an Income Statement this effectively reducing Profit of the entity.

With the former the company will incur an expense related to the cost of borrowing. An overdraft is a facility of extended credit from a bank or a financial institution. Interest expense is one of the core expenses found in the income statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time.

Usually the fee is charged daily weekly or monthly plus interest which can be as high as a 15 to 20 annual percentage rate. Ad Find Overdraft On Bank Account. Content updated daily for banks that allow overdrafts.

3 Loss on disposal - Admin expenses whether its a profit or loss on the disposal. That varies from bank to bank. Ad Find Bank Account Interest.