Matchless Need Of Ratio Analysis

A very useful summary with how each aspect links to each other in order for you to see correlations and develop an A answer.

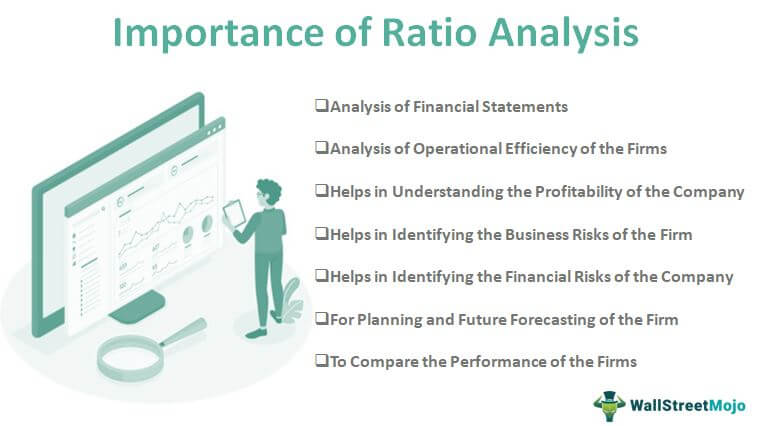

Need of ratio analysis. Ratio Analysis Ratio analysis is used to evaluate relationships among financial statement items. The ratios are used to identify trends over time for one company or to compare two or more companies at one point in time. Ratios It is often necessary to compare a firms performance or different organisations performance over a number of years.

So if I say that ABC firm earned a profit. It is used to visualize and extract information from financial statements. To put it in other words Ratio analysis is the method of analysing and comparing financial data by computing meaningful financial statement value percentages rather than comparing line items from each financial statement.

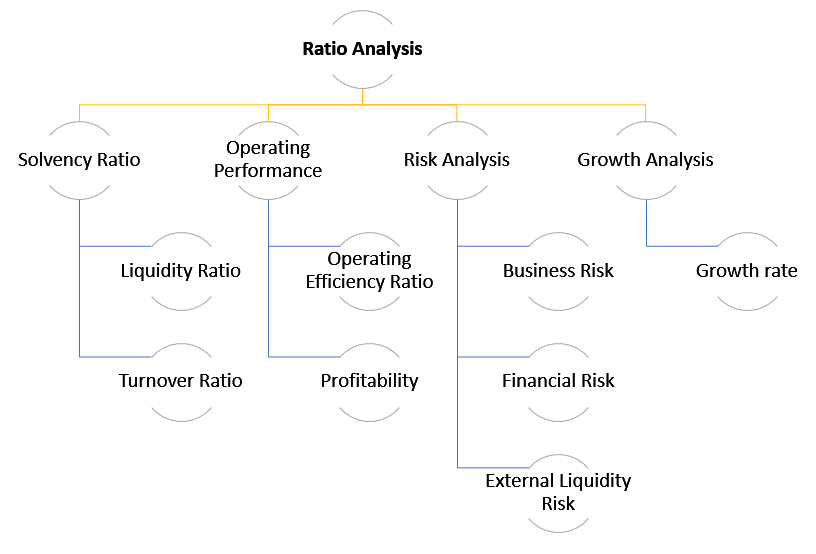

It is often necessary to compare a firms performance or different organisations performance over a number of years. What Is Ratio Analysis. Liquidity profitability and solvency.

Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. 2 Evaluation of Operational Efficiency. Financial statement ratio analysis focuses on three key aspects of a business.

Ratio analysis is a quantitative method of gaining insight into a companys liquidity operational efficiency and profitability by studying its financial statements such as. Ratio analysis has its own merits and demerits too. Ratio analysis can be used to compare the year to year profitability liquidity.

Financial ratio analysis is one of the most popular financial analysis techniques for companies and particularly small companies. Profit is the ultimate aim of every organization. Ratio analysis is a popular technique of financial analysis.