Formidable Organizational Costs On Balance Sheet Gaap

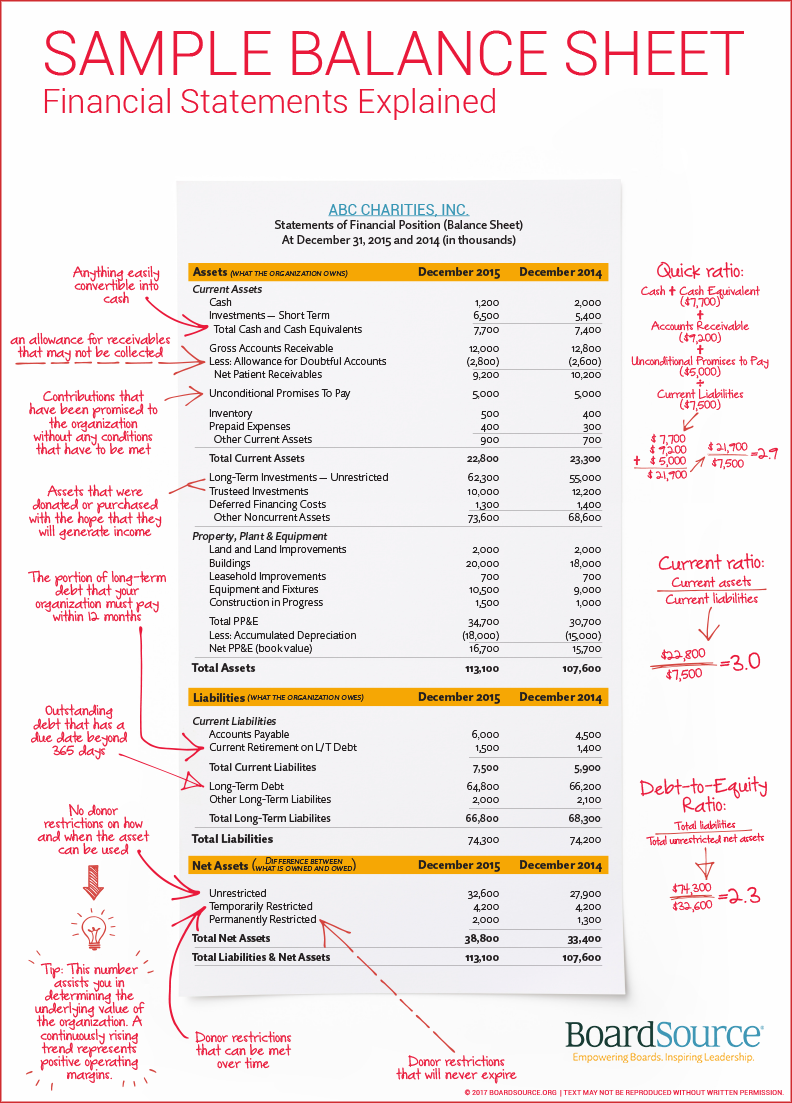

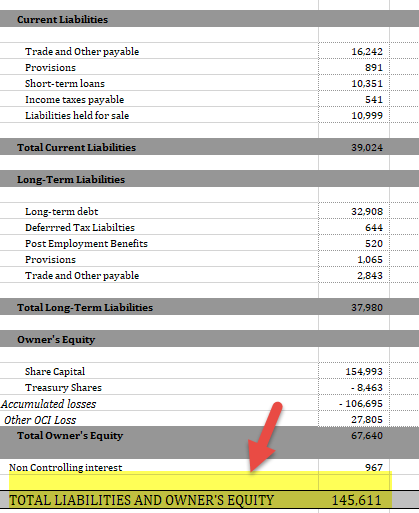

This is GAAP but youll only see it if you look at a comparative balance sheet.

Organizational costs on balance sheet gaap. Organization costs are not an asset at least not under IFRS or US GAAP. You would however amortize cost associated with the issuance of debt using the effective interest method. Since the IRS separates startup costs and organizational costs you can also take a deduction up to 5000 for organizational expenses up to 50000.

Like Section 195 expenses you can claim 5000 of organization costs as a write-off upfront and amortize the rest. If the account went up significantly ask for an explanation of what else was paid out and charged there. These costs must be incurred before the end of the first tax year your company is in business.

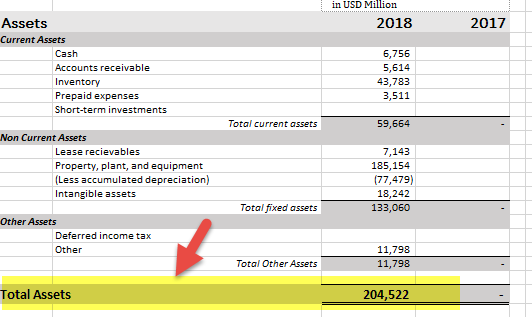

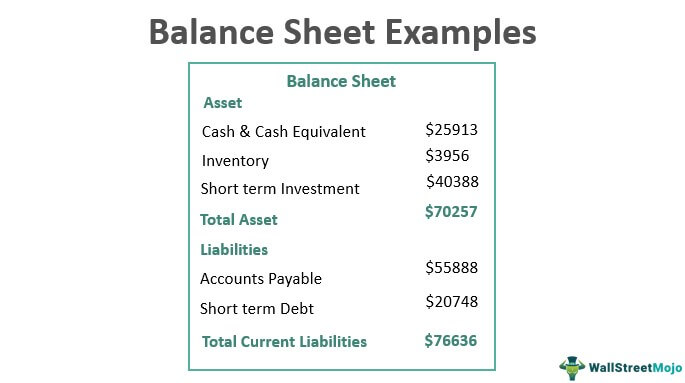

Insurance companies incur expenditures to acquire new clients or to renew a particular contract. Software Development Costs The Company applies the principles of ASC 985-20 Software-Costs of Computer Software to be Sold Leased or Otherwise Marketed ASC 986-20. 1 A companys balance sheet summarizes assets and.

Start up costs typically are placed on the balance sheet as an asset. You balance that with a reduction of 48000 to your cash account. Startup Organization Costs Fees to incorporate or set up a partnership are GAAP startup expenses.

In accordance with GAAP organization costs are expensed when incurred and therefore they do not appear on the. For example if youve spent 23000 preparing your new office and 25000 on market research you record 48000 in startup costs. Generally you will have a consistent amount of prepaid expenses from one year to the next.

Depending on the applicable tax rules it may be possible to capitalize organizational costs in which case they are amortized for tax purposes over a period of time. The amount amortized in the accounting records can be different than the amount amortized for Internal Revenue Service IRS federal reporting requirements ie. Subclassifying Cost of Goods Sold by product is useful from a managerial perspective but in practice it will lead to hundreds of duplicate sub-accounts or the need to reclassify expenses items like direct material or direct wages leading to messy accounting.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)