Exemplary Private Company Financial Reporting Requirements

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

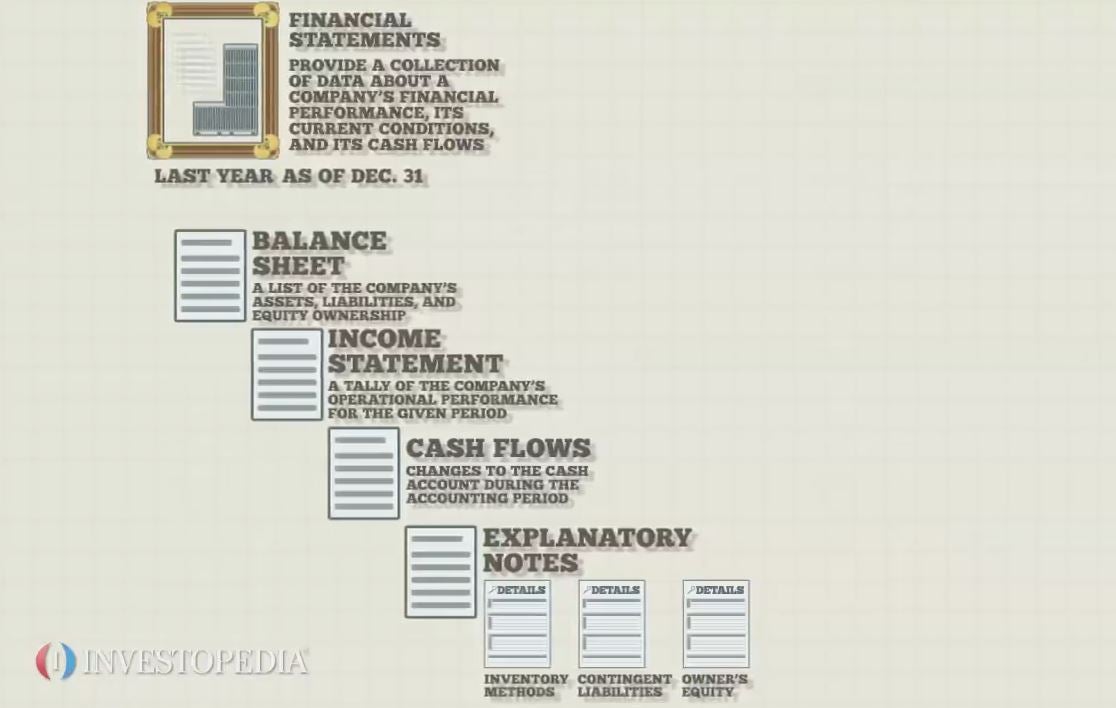

PwCs Private Clients Alert New Financial Reporting Requirements for Private Businesses At a glance The Federal Parliament passed tax legislation on 3 December 2015 which will create significant new disclosure requirements for many privately owned companies and other entities that are not currently subject to financial reporting requirements.

Private company financial reporting requirements. Disclosure Requirements for Private US. 10 rows 6200 General Financial Statement Requirements for Foreign Private Issuers. 6210 Periods for which Financial Statements are Required.

All companies with a public interest score of more than 750 will be audited. For those companies with a score below 350 an audit will nonetheless be required if the company meets the requirements of the activity test. Ad Month-end manual processes by spreadsheet adds complexity and drains valuable resource.

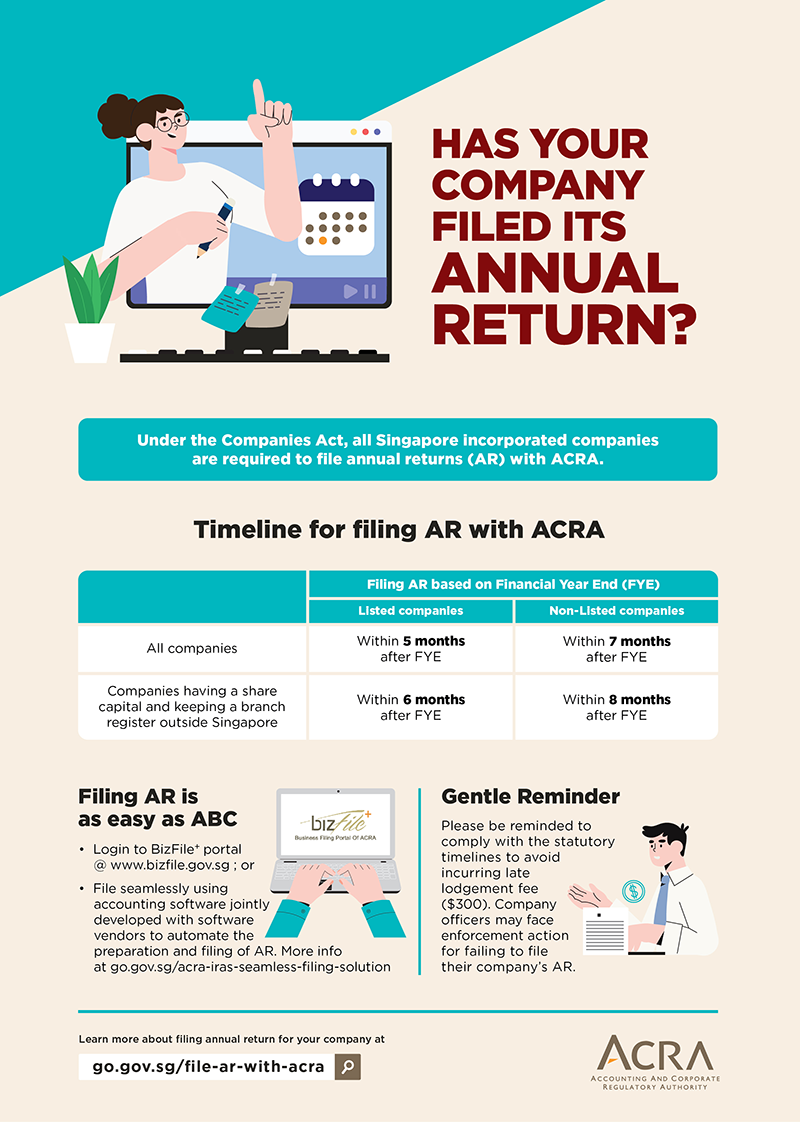

Its imperative that there be a board made up of private company oriented people who would set the different standards affecting the private company financial reporting system. Request a free trial today. The company would be required to file their financial statements in XBRL format during the filing of Annual return if your company is.

A private company must file financial reports with the SEC when it has more than 500 common shareholders and 10 million in assets as set by the Securities and Exchange Act of 1934. 6250 Changes in Fiscal Year. As it stands now issues affecting public companies are what drive accounting standards and impact how they are written.

In the United States and Canada financial-reporting regulations focus on publicly traded securities. Ad Find Financial Company Reports. Research and analyze 3 Million companies.

You May Also Like Filing Financial Statements in XBRL Format. Startups venture-backed PE-backed and public. Ad Combine private company data with our investment research for comprehensive insights.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)