First Class Accounts Receivable Financial Statement In A Common Size Balance Sheet The 100 Figure Is

By expressing the items in proportion to some size-related measure standardized financial statements can be created revealing trends and providing insight into how the different.

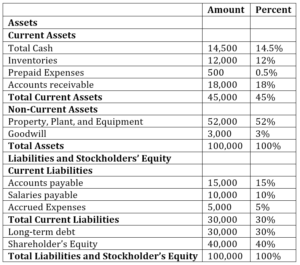

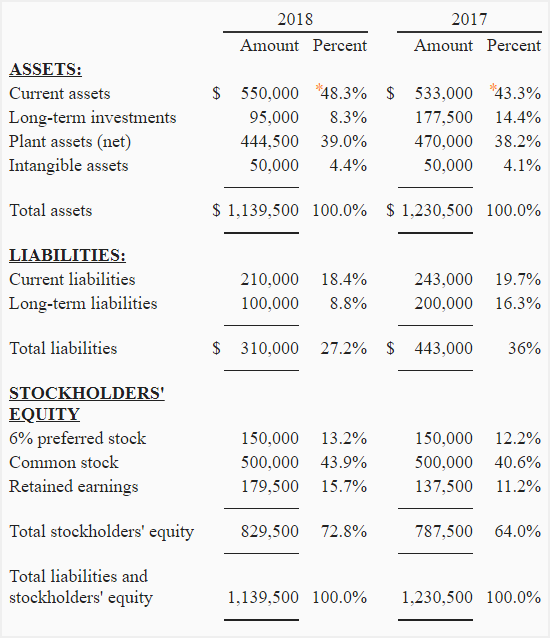

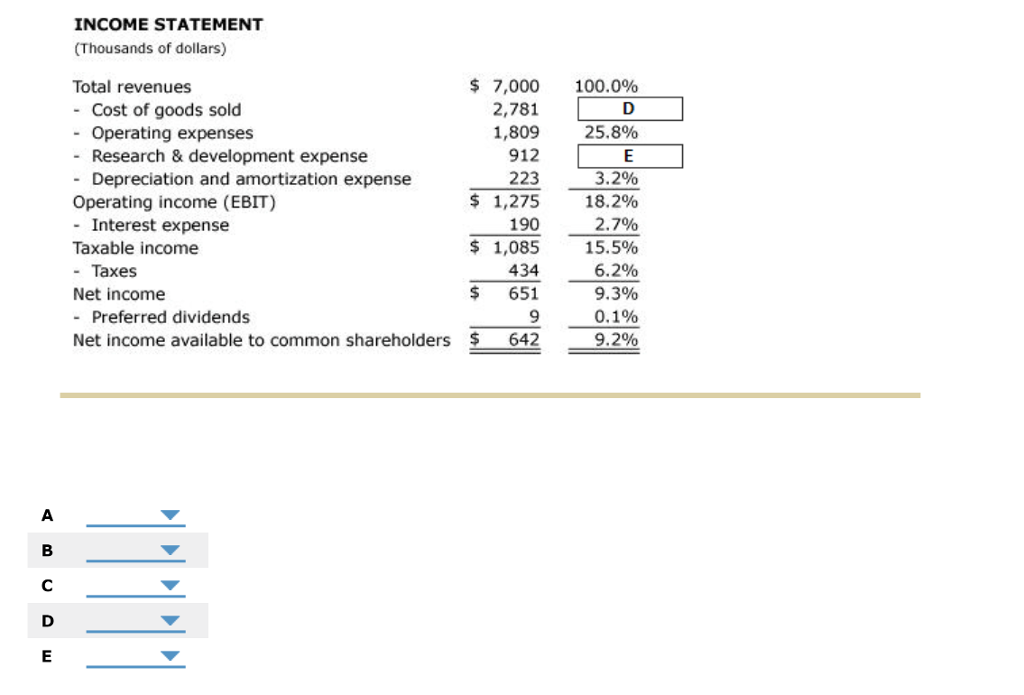

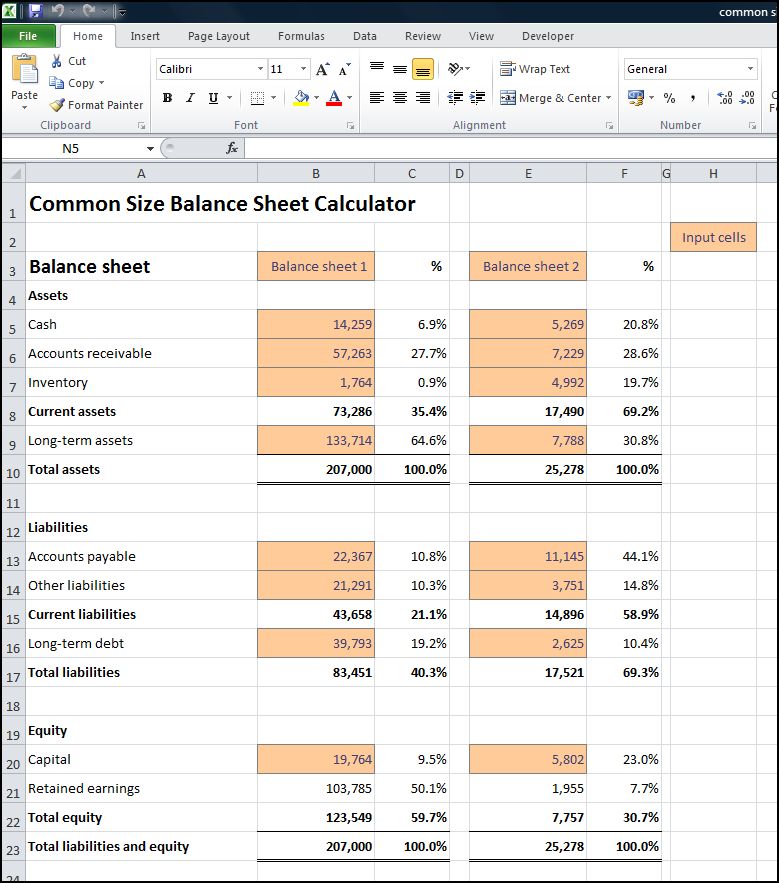

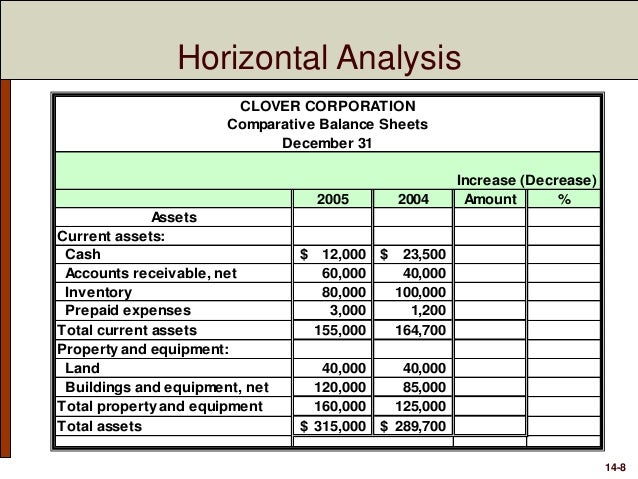

Accounts receivable financial statement in a common size balance sheet the 100 figure is. Steps to prepare Horizontal Common-size Balance Sheet Statement of Financial Position. A common size balance sheet expresses each item on the balance sheet as a percentage of total assets A common size income statement expresses each income statement category as a percentage of total sales revenues 1234 Sales 101840 109876 115609 126974 COGS 78417 83506 85551 93326 SGA 20368 24722 27168 31109. Finance Common-Size Statements.

For example if a company lists 1000 US Dollars USD in accounts receivable and total balance sheet current assets of 8000. Divide the change over the base period figure. Quizlet flashcards activities and games help you improve your grades.

Following is the comparative statement of financial position for the year 2014. In a vertical common-size balance sheet all balance sheet items are expressed as a percentage of total assets. Cannot be stated as a percentage d.

Percentage of an Individual item Amount of the Individual item Amount of Base item 100. A balance sheet can be used to analyze a companys capital structure and ability to pay liabilities. The calculation for each line item is given by.

Common-Size Analysis of the Balance Sheet. Based on the accounting equation this also equals total liabilities and shareholders equity making either term. The financial statements for Burch Industries follow.

To prepare a vertical analysis you select an account of interest comparable to total revenue and express other balance sheet accounts as a. C as if all companies being compared had the same total. Winsor Clothing Store had a balance in the Accounts Receivable account of 760000 at the beginning of the year and a balance of 840000 at the end of the year.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)