Spectacular Goodwill Footnote Disclosure Example

One disclosure example is Thesefinancial statementsarepreparedonagoingconcernbasisbecausetheholdingcompanyhasundertaken toprovidecontinuingfinancialsupportsothattheCompanyisabletopayitsdebtsasandwhen theyfalldue.

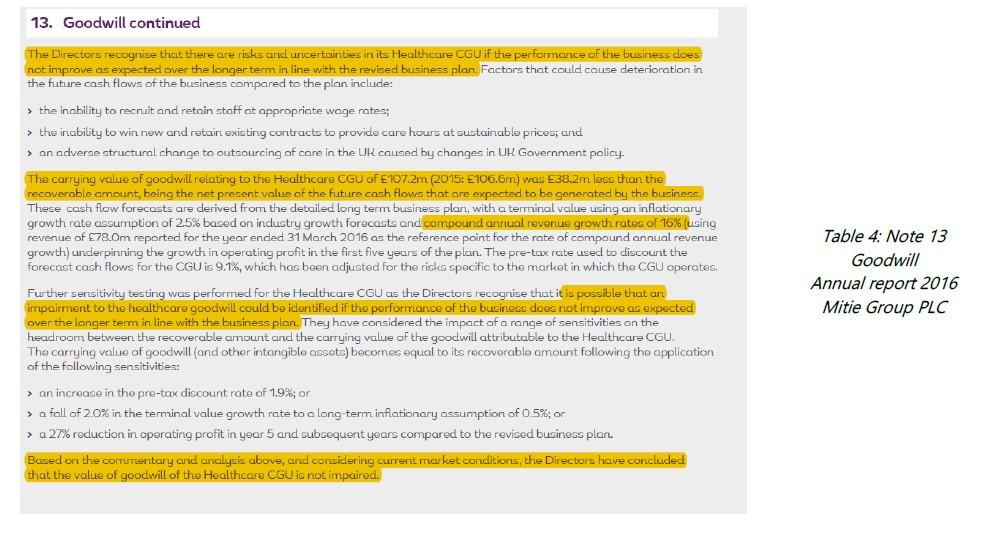

Goodwill footnote disclosure example. Illustrative Disclosures for Recently Issued Accounting Pronouncements. And OCI and Note 10 apply only if the parent. The disclosures are purely for.

Disclosure requirements under the alternative are similar to the disclosures currently required under US. The Example Financial Statements use the terminology in IAS 1 Presentation of Financial Statements. This publication considers the impact of COVID-19 on disclosures relating to going concern and subsequent events in financial statements providing illustrative disclosures and examples of multiple scenarios.

However an entity that elects th accounting e alternative is not required to present changes in goodwill in a tabular reconciliation. Has debt or equity instruments operating segments or ordinary shares potential ordinary shares EPS that are traded in a public market ie. Generally accepted accounting principles GAAP.

Insurance Contracts IFRS 6 Exploration for and Evaluation of Mineral Resources IAS 26 Accounting and Reporting by Retirement Benefit Plans or IAS 34 Interim Financial Reporting. Tabular disclosure of amortization expense of assets excluding financial assets that lack physical substance having a limited useful life. In addition the disclosures required for finite-lived intangible assets would be applicable to goodwill subject to amortization.

These illustrative financial statements which are examples for bank holding companies including community banks thrifts and other financial institutions contain common disclosures as. These illustrative financial statements which are examples for bank holding companies including community banks thrifts and other financial institutions contain common disclosures as required under US. Examples of Financial Statement Footnotes.

The disclosures are purely for. Appendix A contains sample disclosures required by FRS 830 on newrevised FRSs INT FRSs and amendments to FRSs that may be relevant to an entity that were issued but are not effective at the date of authorisation of the financial statements. GAAP as well as rules and regulations of the US.